KPI – January 2025: State of Business – Automotive Industry

Light vehicle sales are expected to increase after a strong end to last year…

- KPI – January 2025: The Brief

- KPI – January 2025: State of Manufacturing

- KPI – January 2025: Consumer Trends

- KPI – January 2025: State of the Economy

- KPI – January 2025: Recent Vehicle Recalls

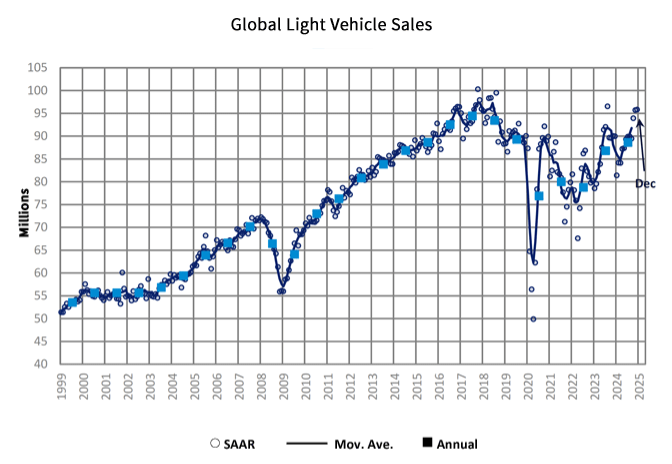

GLOBAL LIGHT VEHICLE SALES

In December, the Global Light Vehicle (LV) selling rate stood at 97 million units per year—a slight improvement from November and “a robust conclusion to 2024,” according to GlobalData. Market volumes experienced 6% year-over-year growth. Global sales totaled 89 million units in 2024 – a 2% increase from the previous year.

Key markets like the U.S., China and Western Europe posted “comfortably higher” year-over-year stats. In particular, U.S. total sales registered 16 million units—the best since the pandemic. Likewise, China’s car market performed well, as government incentives, scrappage subsidies and strong demand for NEVs aided consumer demand.

“While uncertainty remains high as attention shifts to 2025, the outlook has improved in an environment of easing inflationary pressure. Light vehicle sales are projected to increase to 90.8 million units, a 2% increase from 2024,” says Jeff Schuster, vice president of automotive research at GlobalData.

Market Lines is now excluding exports from the China sales total. The adjustment has been backdated to 2018.

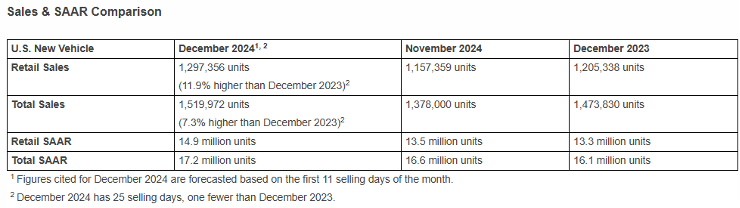

U.S. NEW VEHICLE SALES

Total new-vehicle sales for December 2024, including retail and non-retail transactions, are projected to reach 1,520,000—a 7.3% year-over-year increase on a selling day adjusted basis, according to a joint forecast from J.D. Power and GlobalData.

“December results will cap off the year with a strong performance, highlighted not only by robust year-over-year sales growth, but also by the fact that consumer expenditures on new vehicles will reach the highest level for any month on record,” says Thomas King, president of the data and analytics division at J.D. Power.

Takeaways, courtesy of JD Power:

- Retail buyers are on pace to spend $56.4 billion on new vehicles, up $4.2 billion year-over-year.

- Trucks/SUVs are estimated to account for 82.4% of new-vehicle retail sales in December 2024 when totals are finalized.

- The average new vehicle retail transaction price is expected to reach $45,471, down $150 year-over-year.

- Average incentive spending per unit is expected to reach $3,442, up $809 year-over-year.

- Total retailer profit per unit, which includes vehicles gross plus finance and insurance income, is expected to be $2,107—down 19.7% year-over-year.

- Fleet sales are expected to total 222,616 units in December, down 13.8% year-over-year. Fleet volume is on pace to account for 14.6% of total light-vehicle sales, down 3.6 percentage points from a year ago.

- Average interest rates for new vehicle loans are expected to be 6.09%, down 62 basis points from last year.

“Despite challenges like high interest rates and declining trade-in values, the new vehicle market remains strong. While per-unit profits are declining, resilient consumer demand—assisted by increased inventory and leasing activity—has supported a solid year-end performance,” King says. “As the positive trends of 2024 continue into 2025, improved overall inventory and greater availability of affordable vehicles are expected to sustain sales momentum. Transaction prices and profitability for OEMs and retailers are likely to moderate slightly. However, this tradeoff between higher sales volumes and lower margins will ensure total profitability remains strong compared to historical levels.”

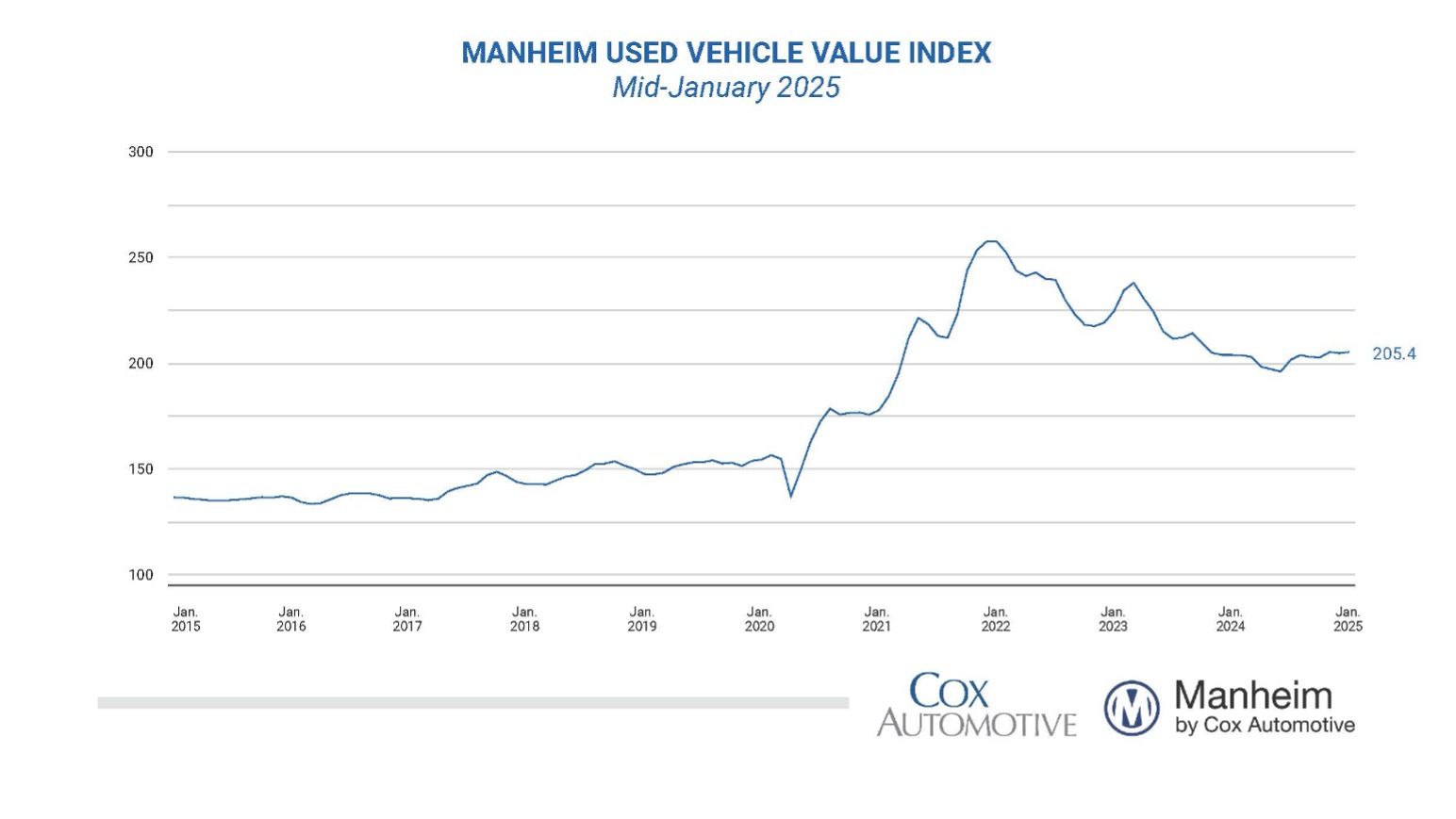

U.S. USED MARKET

Wholesale used-vehicle prices (on a mix-, mileage- and seasonally adjusted basis) were higher than those of December in the first 15 days of January. The mid-month Manheim Used Vehicle Value Index rose to 205.4, posting a gain of 0.7% from the full month of January 2024.

“Early in the year, it’s best to let the dust settle on wholesale prices, but values at Manheim are showing pretty normal trends in the first few weeks of 2025,” says Jeremy Robb, senior director of economic and industry insights at Cox Automotive. “We typically see a small rise in non-seasonally adjusted values for the full month of January, and we are up about a tenth-of-a-point more than we usually observe early in the month. While we need to see what happens over the rest of January, non-seasonally adjusted prices are showing their second gain in a row year-over-year, higher by 1%. With tighter used retail supply and ever-rising new vehicle prices, demand for used vehicles in our wholesale markets remains healthy.”

According to Manheim, major market segments saw mixed results for seasonally adjusted, year-over-year in the first half of January. The luxury and SUV segments performed best, inching up 0.8% and 0.6%, respectively.

All other segments were lower year-over-year, with midsize sedans, pickups and compact cars down 1.6%, 1.7% and 3.1%, respectively. EVs were down 4.5% compared to January 2024, while the non-EV segment increased 0.2%.