- KPI – February 2025: The Brief

- KPI – February 2025: Recent Vehicle Recalls

- KPI – February 2025: State of Business – Automotive Industry

- KPI – February 2025: State of the Economy

- KPI – February 2025: Consumer Trends

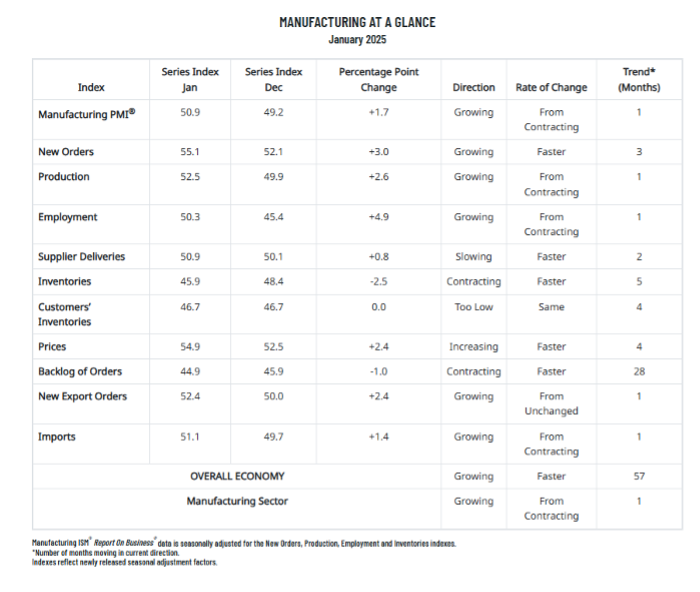

Economic activity in the manufacturing sector expanded in January for the first time in more than two years, say the nation’s supply executives in the latest Manufacturing ISM Report On Business.

“U.S. manufacturing activity expanded in January after 26 consecutive months of contraction. Demand clearly improved, while output expanded and inputs remained accommodative,” says Timothy R. Fiore, CPSM, C.P.M., chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee.

While employment expanded, staff reductions continued within many companies – albeit at weaker rates.

“(In addition,) price growth was moderate, indicating that further growth will put additional pressure on prices. As predicted, maintaining a slower rate of price increases as demand returns will be a major challenge for 2025,” Fiore explains.

Data shows approximately 43% of manufacturing gross domestic product (GDP) contracted in January, down from 52% in December. According to the Institute for Supply Management (ISM), the share of manufacturing sector GDP registering a composite PMI calculation at or below 45% (a good barometer of overall manufacturing weakness) registered 8% in January – “a dramatic 41 percentage point improvement compared to the 49% reported in December.”

Important takeaways, courtesy of the Manufacturing ISM Report On Business:

- Demand improvement includes: the (1) New Orders Index moving further into expansion territory; (2) New Export Orders Index moving back into expansion; (3) Backlog of Orders Index dropping slightly and continuing in contraction; and (4) Customers’ Inventories Index remaining in “too low” territory.

- Output (measured by the Production and Employment indexes) was positive, as factory output improved compared to December, indicating that panelists’ companies are proceeding with growth plans.

- Employment was stable as final headcount adjustments were made, in many cases among the white collar workforces.

- Inputs – defined as supplier deliveries, inventories, prices and imports – generally continued to accommodate future demand growth. While inventories declined, imports returned to expansion, prices increased and supplier deliveries slowed marginally.

What respondents are saying, according to the Manufacturing ISM Report On Business:

- “Customer orders slightly stronger than expected. Seeing more general price increases for chemicals/raw materials. No International Longshoremen’s Association strike is a tremendous help.” (Chemical Products)

- “Alleviating supply chain conditions are noticeably pivoting back into acute shortage situations, with headwinds following. For aerospace and defense companies, critical minerals supply chains are tightening dramatically due to Chinese restrictions. Concerns are growing of an environment of more supply chain shortages.” (Transportation Equipment)

- “As the U.S. administration transfers, we will continue to monitor the impact of tariffs on materials used for manufacturing. China stimulus is helping us win orders and increase use of services and consumables. Cost pressures remain for all materials and parts but are starting to stabilize.” (Computer & Electronic Products)

- “Volume in 2025 is targeting 2% growth. The organization is mindful of potential tariffs and what to do with rerouting or cost increases in supply chains that are impacted.” (Food, Beverage & Tobacco Products)

- “Although we are in our busy season, our demand for the first two weeks of 2025 has outpaced normal levels for this period of time.” (Machinery)

- “Business is slowly improving.” (Electrical Equipment, Appliances & Components)

- “Capital equipment sales are starting 2025 off strong. Normally, we see a soft start to the year, so this strong start is unusual.” (Fabricated Metal Products)

- “New orders are still good but decreasing compared to previous quarters. Working through current backlog.” (Miscellaneous Manufacturing)

- “Automotive order demand continues to be consistent and on a steady pace. Beginning to look at hiring additional team members once again. Pricing is holding firm. Having to work overtime to cover plant inefficiency to date.” (Primary Metals)

- “Looking forward to a year of strong customer demand and higher sales than 2024.” (Textile Mills)