- KPI – December 2025: The Brief

- KPI – December 2025: State of Manufacturing

- KPI – December 2025: State of Business – Automotive Industry

- KPI – December 2025: State of the Economy

- KPI – December 2025: Recent Vehicle Recalls

The following is a synopsis of consumer sentiment, confidence, demand and income/spending trends.

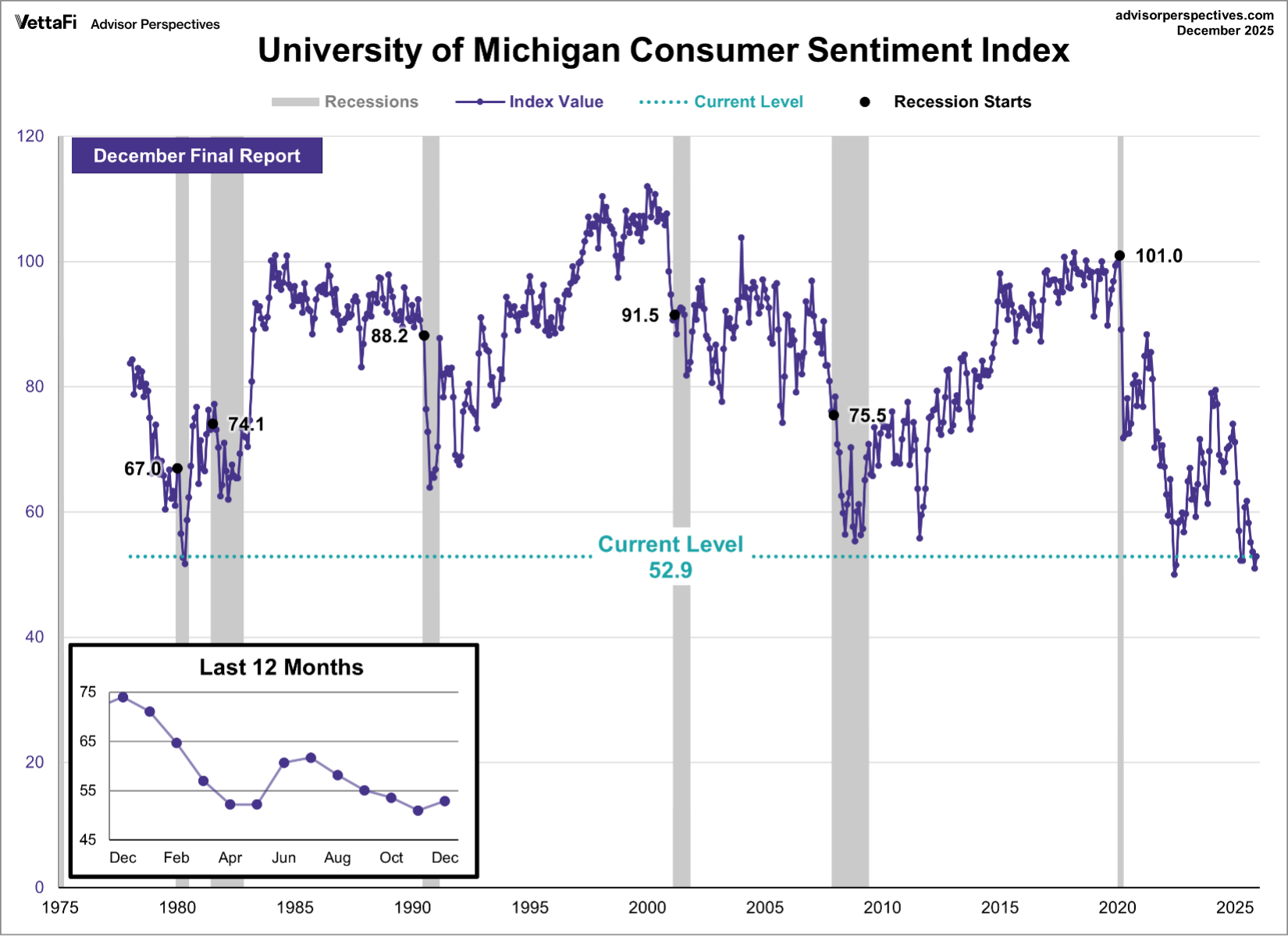

Sentiment

The University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – registered 51.0 in November and posted a preliminary reading of 52.9 in December.

“While lower-income consumers posted gains, sentiment for higher-income consumers was little changed. Buying conditions for durable goods fell for the fifth straight month, whereas expectations for personal finances and business conditions rose in December. Labor market expectations lifted a bit this month, though a solid majority of 63% of consumers still expects unemployment to continue rising during the next year,” according to Joanne Hsu, director at Survey of Consumers.

Caption: To put today’s report in historical context, consumer sentiment is currently 39.4% below its average reading of 84.2 (arithmetic mean) and 38.6% below its geometric mean of 83.0, based on historical data dating back to 1978. The current index level is at the 0th percentile of the 575 monthly data points in this series.

Key takeaways, courtesy of Survey of Consumers:

- Year-ahead inflation expectations decreased for the fourth consecutive month to 4.2% – the lowest reading in 11 months, but still above the 3.3% seen in January.

- Long-run inflation expectations eased from 3.4% last month to 3.2% in December, matching the January 2025 reading. In comparison, readings ranged between 2.8 and 3.2% last year and were below 2.8% throughout 2019 and 2020.

“Despite some signs of improvement to close out the year, sentiment remains nearly 30% below December 2024, as pocketbook issues continue to dominate consumer views of the economy,” Hsu says.

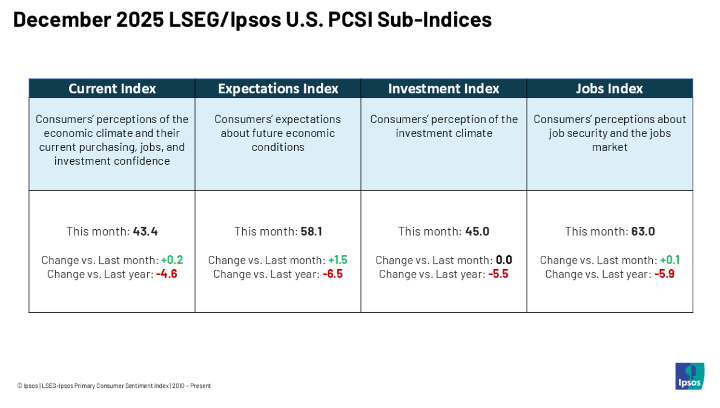

Caption: The LSEG/Ipsos Primary Consumer Sentiment Index for December 2025 is at 51.9. Fielded from Nov. 21-26, 2025, the Index is up 0.5 point from last month.

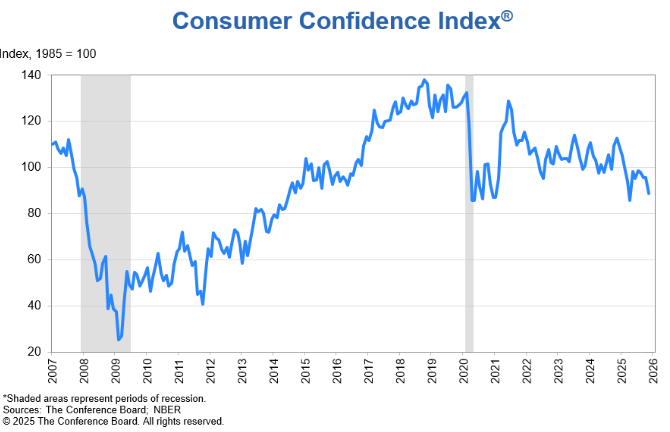

Confidence

Editor’s note: The most recent Consumer Confidence data available at the time of publication was from November 2025.

The Conference Board Consumer Confidence Index nosedived 6.8 points in November to 88.7 (1985=100). The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – fell by 4.3 points to 126.9. Meanwhile, the Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – decreased 8.6 points to 63.2.

“Consumer confidence tumbled in November to its lowest level since April after moving sideways for several months. All five components of the overall index flagged or remained weak,” says Dana M Peterson, chief economist at The Conference Board.

The Present Situation Index declined, “as consumers were less sanguine” about current business and labor market conditions. Similarly, the labor market differential – the share of consumers who say jobs are “plentiful” minus the share saying “hard to get” – dipped in November (after a brief respite in October compared to its year-to-date decline).

All three components of the Expectations Index deteriorated as well. According to Peterson, consumers were notably more pessimistic about business conditions six months down the line. Mid-2026 expectations for labor market conditions remained “decidedly negative,” and expectations for increased household incomes shrunk significantly, following six months of strongly positive readings.

On a six-month moving average basis, confidence continued to improve for consumers under 35 years old but decrease for those over 35 – especially respondents 55-plus. Last month, confidence fell among most income levels after several months of promising increases across most groups. Confidence decreased among consumers of all political backgrounds, with the sharpest decline among independent voters.

Key takeaways, courtesy of The Conference Board:

- Consumers’ year-ahead outlook for stock prices remained “strongly positive” but a hair less confident than in October.

- The share of consumers expecting interest rates to rise edged lower to approximately 50%, while the proportion expecting lower rates ticked down after rising over the past several months.

- Consumers’ views of their Family’s Current and Future Financial Situation stumbled in November. “Assessments of current financial situations collapsed to near the low levels seen in August 2024, when a confluence of negative events stoked a brief financial market selloff and U.S. recession concerns.” Perceptions of future family financial situations were also less buoyant.

- The share of consumers believing a recession is “very likely” over the next 12 months fell further in November, but the share of consumers thinking the economy was already in recession rose for the fourth consecutive month. The share saying a recession is “somewhat likely” also ticked up.

- Plans for buying big-ticket items over the next six months declined in November following little change since May. Expectations for purchasing cars, household appliances and most electronics ticked downward in November. Nonetheless, used cars, TVs and smartphones remained the most popular future purchases among these categories. Homebuying expectations also ticked down in November but remained near two-year highs. In November, consumers also curbed planned spending on services over the next six months.

“Consumers’ write-in responses pertaining to factors affecting the economy continued to be led by references to prices and inflation, tariffs and trade, as well as politics, with increased mentions of the federal government shutdown. Mentions of the labor market eased somewhat but still stood out among all other frequent themes not already cited,” Peterson says. “(As such), the overall tone from November write-ins was slightly more negative than in October.”

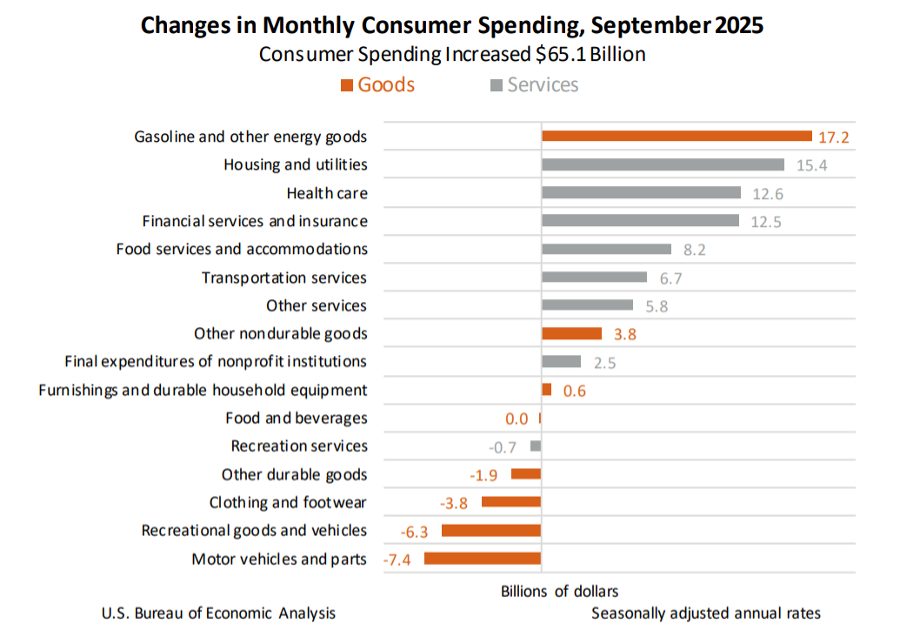

Consumer Income & Spending

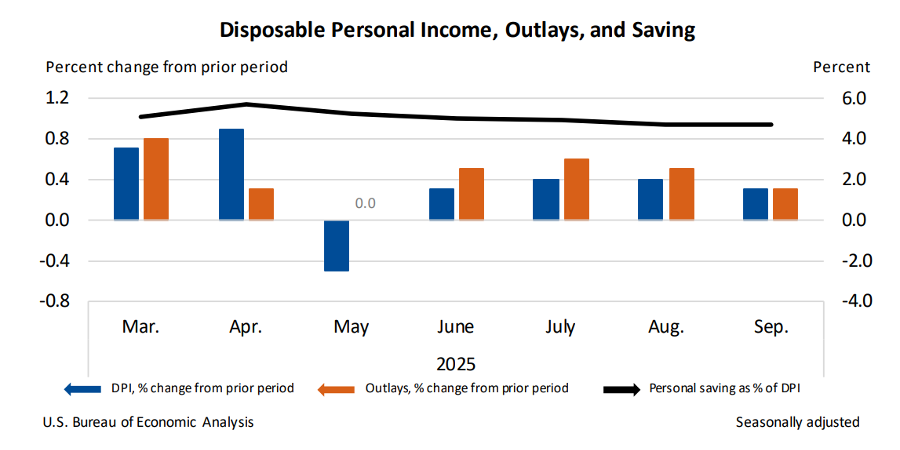

In September, personal income increased $94.5 billion (0.4% at a monthly rate), according to the U.S. Bureau of Economic Analysis. In addition, disposable personal income (DPI) – personal income less personal current taxes – increased $75.9 billion (0.3%) and personal consumption expenditures (PCE) increased $65.1 billion (0.3%).

Personal outlays – the sum of PCE, personal interest payments and personal current transfer payments – jumped $70.7 billion. Personal saving was $1.09 trillion, while the personal saving rate – personal saving as a percentage of disposable personal income – registered 4.7%.

Key takeaways, courtesy of the U.S. Bureau of Economic Analysis:

- The $65.1 billion increase in current-dollar PCE reflected increases of $63 billion in spending on services and $2.1 billion in spending on goods.

- Excluding food and energy, the PCE price index for September increased 0.2% from the month prior and 2.8% year-over-year.