KPI — December 2022: State of the Economy

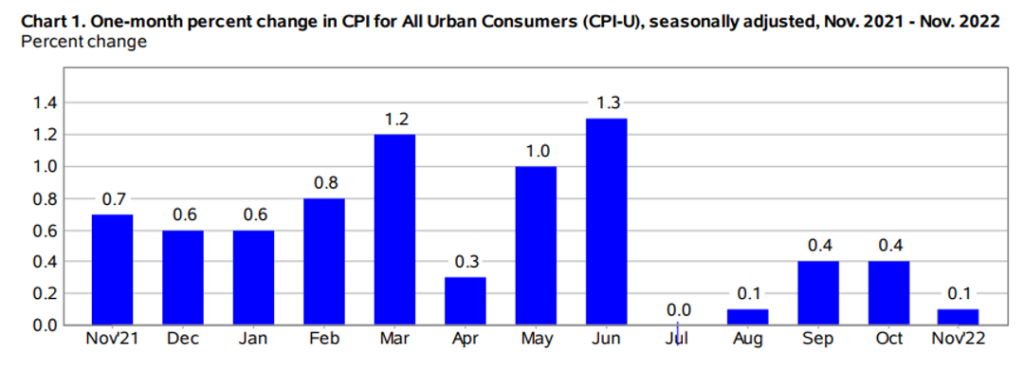

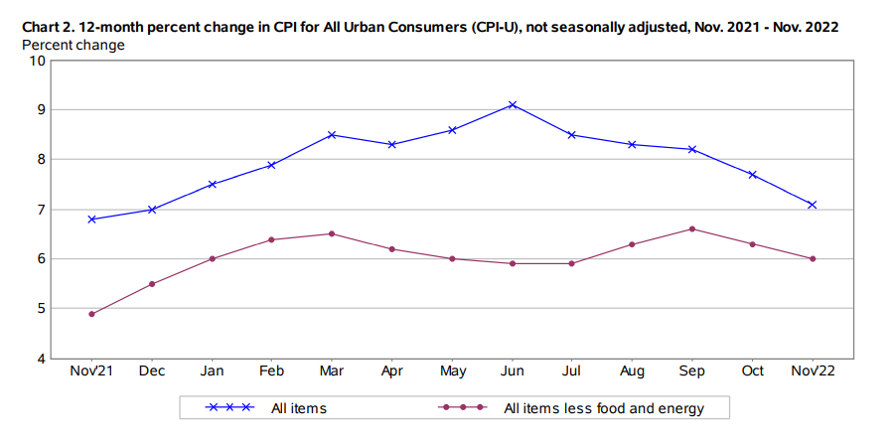

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1% in November on a seasonally adjusted basis, after increasing 0.4% in October, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 7.1% before seasonal adjustment – the smallest 12-month increase since December 2021.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- The indexes for shelter, communication, recreation, motor vehicle insurance, education and apparel increased month-over-month, while used cars and trucks, medical care, as well as airline fares decreased.

- The index for shelter was by far the largest contributor to the monthly all-items increase, more than offsetting decreases in energy. The food and food-at-home indexes both increased 0.5%, while the energy index decreased 1.6% since last month.

- The all items less food and energy index rose 6% over the last 12 months. The energy index increased 13.1% and the food index increased 10.6% over the last year.

Employment

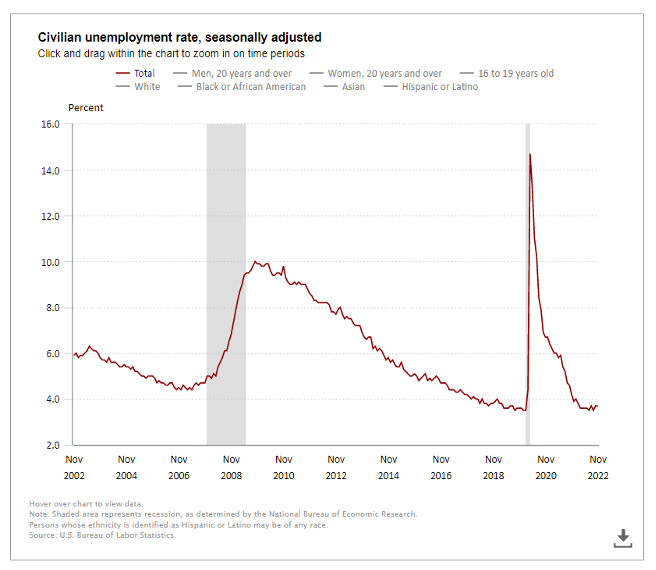

In October, the unemployment rate remained unchanged at 3.7% and the number of unemployed persons held steady at six million, according to the U.S. Bureau of Labor Statistics.

Important Takeaways, Courtesy of the Bureau of Labor Statistics:

- The number of persons on temporary layoff was relatively unchanged at 803,000.

- Among the unemployed, the number of permanent job losers rose by 127,000 to 1.4 million.

- The number of long-term unemployed (those jobless for 27 weeks or more) increased to 1.2 million, accounting for 20.6% of all unemployed persons.

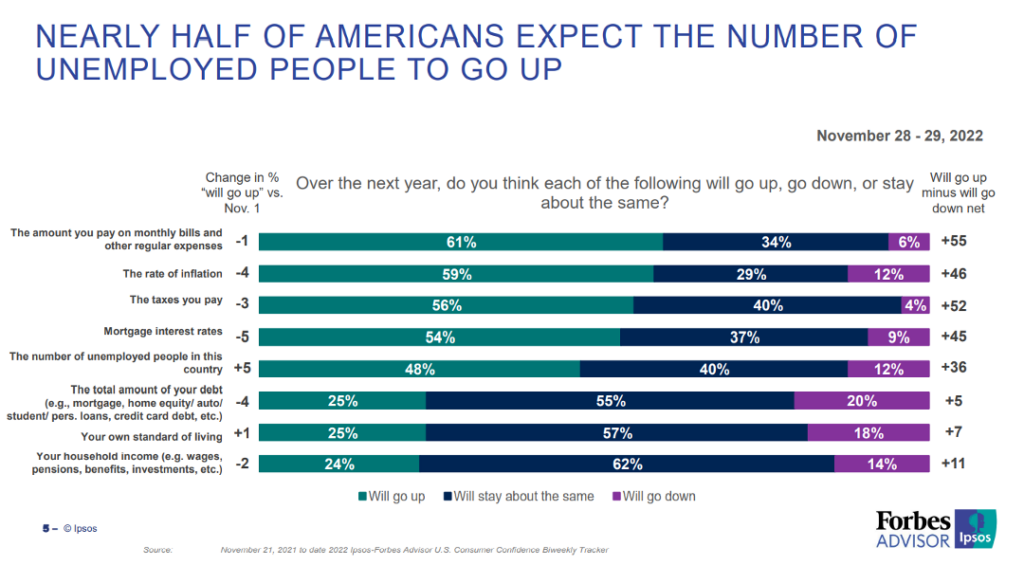

While the labor market currently remains strong, expert opinions about the overall economy range from a pending deep recession to a projected soft landing. In fact, JPMorgan Chase CEO Jamie Dimon – head of the largest bank in the U.S. – first sounded the alarm over the state of the economy back in early May. He cited serious concerns over inflationary pressures, a “hawkish” Federal Reserve and the war in Ukraine.

Now, he warns “stubbornly-high inflation” could trigger a U.S. economic recession next year. On paper, he notes businesses are still in good shape and consumer spending remains strong, with households hoarding $1.5 trillion in excess savings from pandemic relief programs.

“But inflation is eroding everything I just said, and that $1.5 trillion will run out sometime mid-year next year,” Dimon explained during an interview on CNBC. “When you are looking that forward, those things very well may derail the economy and cause this mild to severe recession that people are worried about.”

According to Fox News contributor Megan Henney, the economic outlook is even more uncertain as a result of the Federal Reserve’s most aggressive rate-hike campaign since the 1980s. While the U.S. central bank relentlessly pursues one of the fastest monetary tightening paths in decades, it continues to struggle to rein in consumer prices running near a 40-year high.

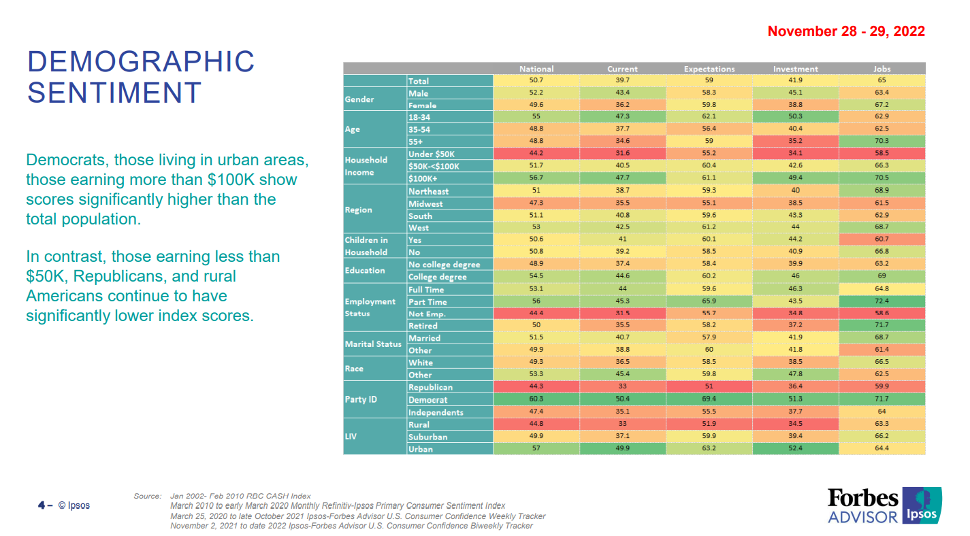

By Demographic

This month, unemployment rates among the major worker groups: adult women – 3.3%; adult men – 3.4%; teenagers – 11.3%; Asian – 2.7%; White – 3.2%; Hispanic – 3.9%; and Black – 5.7%.

Last month, unemployment rates among the major worker groups: adult women – 3.4%; adult men – 3.3%; teenagers – 11%; Asian – 2.9%; White – 3.2%; Hispanic – 4.2%; and Black – 5.9%.

*Unemployment rates increased across various categories, including adult women, Asian, White, Hispanic and Black worker groups.

By Industry

Total nonfarm payroll employment increased by 263,000 in November, above the Dow Jones estimate of 200,000. Monthly job growth has averaged 392,000 thus far in 2022, compared with 562,000 per month in 2021. Notable job gains occurred in leisure and hospitality, health care and government. Employment declined in retail trade, transportation and warehousing.

“To have 263,000 jobs added even after policy rates have been raised by some [375] basis points is no joke,” says Seema Shah, chief global strategist at Principal Asset Management. “The labor market is hot, hot, hot, heaping pressure on the Fed to continue raising policy rates.”

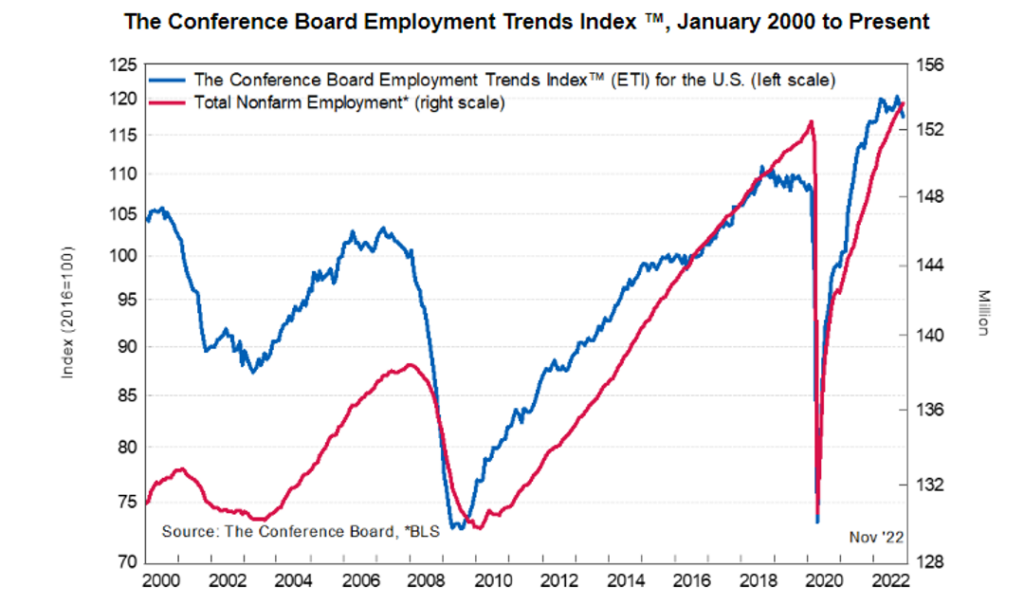

While the labor market is still robust, the fourth consecutive decline in the number of temporary help services jobs – a component of the Employment Trends Index™ and an important leading indicator for hiring – is a warning sign that job growth may slow going into 2023, explains Frank Steemers, senior economist at The Conference Board.

“The demand for workers is still resilient and wage growth continues to be elevated. With the number of employees quitting still high – and the labor supply still constrained – employers may continue to offer strong pay increases to their existing workers and new hires over the coming months,” Steemers says. “However, with the economy expected to slow further in 2023 amid the Federal Reserve’s rapid interest rate hikes, we expect the U.S. labor market to cool and possibly even record some monthly job losses.”

“That said, labor shortages are unlikely to disappear altogether, with the unemployment rate projected to rise from the current 3.7% to a still-low 4.5% in 2023. Employers may need to manage recruitment and retention difficulties, as well as rising labor costs, into the new year and beyond,” he adds.

The Conference Board Employment Trends Index™ (ETI) declined in November to 117.65 from a downwardly revised 118.74 in October 2022. The Employment Trends Index is a leading composite index for employment. When the index increases, employment is likely to grow as well, and vice versa. Turning points in the index indicate that a turning point in the number of jobs is about to occur in the coming months.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- Employment leisure and hospitality added 88,000 jobs in November, including a gain of 62,000 in food services and drinking places. Leisure and hospitality added an average of 82,000 jobs per month thus far this year, less than half the average gain of 196,000 jobs per month in 2021. Employment in leisure and hospitality is below its pre-pandemic February 2020 level by 980,000, or 5.8%.

- Employment in health care edged up by 45,000, with gains in ambulatory health care services (+23,000), hospitals (+11,000), as well as nursing and residential care facilities (+10,000). Thus far, health care employment increased by an average of 47,000 per month, well above the 2021 average monthly gain of 9,000.

- Construction employment continued to grow (+20,000), with non-residential building adding 8,000 jobs. Construction added an average of 19,000 jobs per month thus far this year, relatively unchanged from the 2021 average of 16,000 per month.

- Manufacturing employment continued to trend up (+14,000). Job growth averaged 34,000 per month thus far this year, relatively unchanged from the 2021 average of 30,000 per month.

Review all employment statistics here.

The NFIB Small Business Optimism Index rose 0.6 points in November to 91.9. November’s reading is the 11th consecutive month below the 49-year average of 98. Forty-four percent of owners reported job openings that were hard to fill, down two points from October but still historically high. The difficulty in filling open positions is particularly challenging in the transportation, wholesale and construction sectors. Owners’ plans to fill open positions remain elevated, with a net 18% (seasonally adjusted) planning to create new jobs in the next three months. The net percent of owners raising average selling prices increased one point to a net 51% seasonally adjusted; however, owners expecting better business conditions over the next six months improved three points from October to a net negative 43%.

KPI — December 2022: Consumer Trends

Key Performance Indicators Report — December 2022