KPI — August 2022: State of Business — Automotive Industry

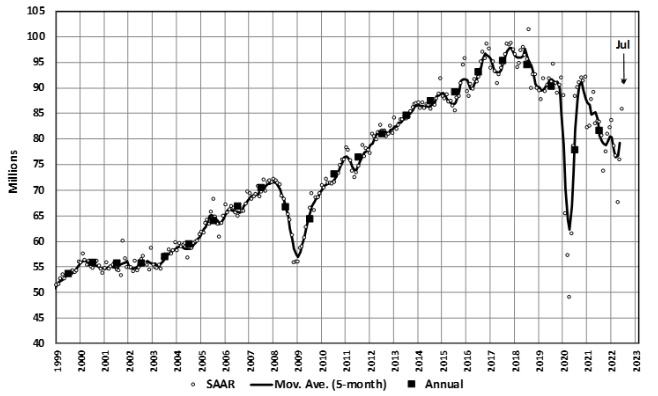

LMC Automotive reports Global Light Vehicle (LV) sales improved to 90 million units per year in July but remains down 6.4% year-over-year. While China continues to recover and spur an increased global selling rate, other major markets remain hamstrung by ongoing conflict in Ukraine.

“While there is near-term upside potential in China, we believe volume will cool as inventory becomes tight, given strength of demand. That risk, combined with further downside in Europe and North America, keeps risk elevated for the remainder of 2022 and into 2023,” says Jeff Schuster, president of Americas operations and global vehicle forecasts at LMC Automotive.

The July Manufacturing PMI® registered 52.8%, down 0.2 percentage point from a reading of 53% in June, according to supply executives in the latest Manufacturing ISM® Report On Business®.

“The U.S. manufacturing sector continues to expand – though slightly less so in July – as new order rates continue to contract, supplier deliveries improve and prices soften to acceptable levels. According to Business Survey Committee respondents’ comments, companies continue to hire at strong rates, with few indications of layoffs, hiring freezes or headcount reduction through attrition,” says Timothy R. Fiore, CPSM, C.P.M., chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee.

However, Fiore says panelists reported higher rates of quits, reversing June’s positive trend. Price expansion eased dramatically in July, he notes, but instability in global energy markets continues. While sentiment remained optimistic regarding demand, panelists are now expressing concern about a softening in the economy, as new order rates contracted for the second month amid developing anxiety about excess inventory in the supply chain.

Important takeaways, courtesy of the Manufacturing ISM® Report On Business®:

- Demand dropped, with the (1) New Orders Index contracting again, (2) Customers’ Inventories Index remaining at a low level but approaching 40% and (3) Backlog of Orders Index decreasing but still in growth territory.

- Consumption (measured by the Production and Employment indexes) was mixed during the period, with a combined positive 1.2-percentage point impact on the Manufacturing PMI® calculation.

- The Employment Index contracted for the third month in a row after expanding for eight straight months (September 2021 through April), but panelists again indicated month-over-month improvement in hiring ability in July. Challenges with turnover (quits and retirements) and resulting backfilling continue to plague efforts to adequately staff organizations.

- Inputs – expressed as supplier deliveries, inventories and imports – continued to constrain production expansion but to a significantly lesser extent compared to June.

- The Supplier Deliveries Index indicated deliveries slowed at a slower rate in July, which was supported by an increase in the Inventories Index.

- The Imports Index continued to expand in July after one month of contraction preceded by six straight months of growth.

- The Prices Index increased for the 26th consecutive month, at a much slower rate compared to June.

U.S. New Vehicle Sales

Total new-vehicle sales for July 2022, including retail and non-retail transactions, are projected to reach 1,159,700 units, a 5.7% decrease from July 2021, according to a joint forecast from J.D. Power and LMC Automotive.

The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 13.7 million units, down 0.9 million units from 2021.

“July is yet another month where supply constraints keep vehicle sales artificially low but deliver record transaction prices and dealer profitability,” says Thomas King, president of the data and analytics division at J.D. Power.

Important Takeaways, Courtesy of J.D. Power:

- Buyers are on pace to spend $45.3 billion on new vehicles, down $1.7 billion from July 2021.

- Truck/SUVs are on pace to account for 79.3% of new vehicle retail sales in July.

- The average new vehicle retail transaction price in July is expected to reach $45,869. The previous high for any month – $45,988 – was set in June 2022.

- Average incentive spending per unit in July is expected to reach $894, down from $1,975 in July 2021. Spending as a percentage of the average MSRP is expected to fall to a record low of 1.9%, down 2.7 percentage points from July 2021.

- Higher prices and smaller discounts, coupled with rising interest rates, mean monthly loan payments on new vehicles have reached an all-time high, breaking the $700 level for the first time.

- Total retailer profit per unit, inclusive of grosses and finance and insurance income from new vehicle sales, are expected to reach first-half record levels on both a per unit and total basis. Profit per unit for the first half of 2022 is trending to reach $4,774, up $2,206 year-over-year. Meanwhile, total profits are expected to reach $27.8 billion, up $9.4 billion from 2021.

- Fleet sales are expected to total 171,300 units in July, up 40% year-over-year on a selling day adjusted basis. Fleet volume is expected to account for 15% of total light-vehicle sales, up from 10% a year ago.

“In August, the overall industry sales pace will continue to be constrained by procurement, production and distribution challenges. Consumer demand remains markedly higher than supply, all of which points to a continuation of the current marketplace dynamics of depressed sales volumes but record pricing and profitability,” King says. “Longer term, the inevitable increase in production levels – coupled with higher interest rates and weakening economic conditions – will likely lead to a rebalancing of the current volume/price dynamic.”

“That said, the significant levels of pent-up demand for new vehicles mean the industry is generally well positioned to continue delivering strong financial results, despite the fact economic conditions and rising interest rates will cause some potential buyers to defer new-vehicle purchases,” he continues.

U.S. Used Market

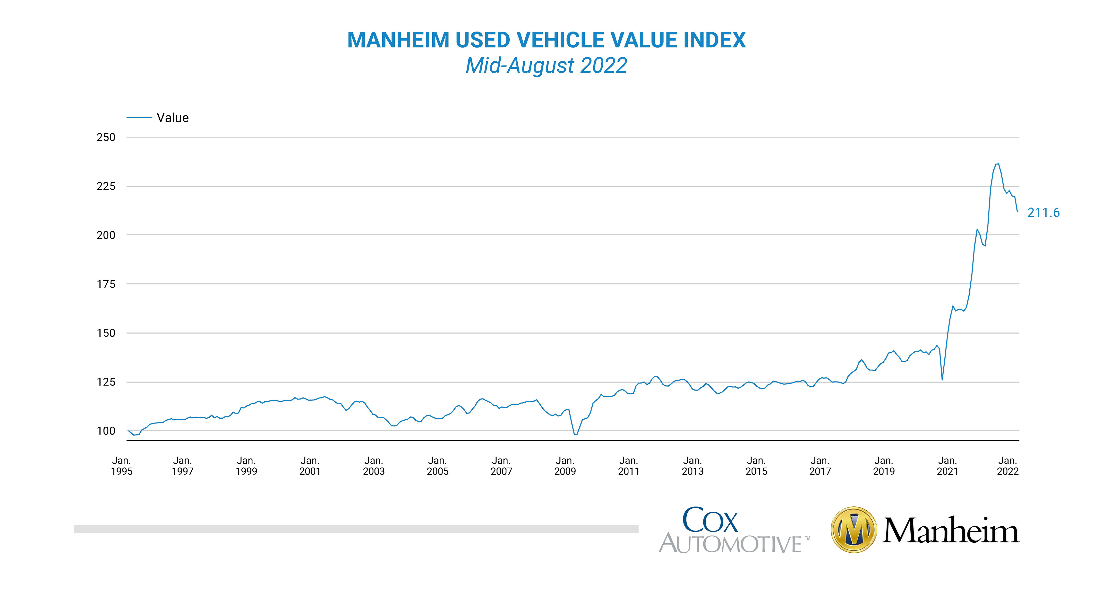

Wholesale used-vehicle prices (on a mix-, mileage- and seasonally adjusted basis) declined 3.6% from July in the first 15 days of August. The Manheim Used Vehicle Value Index fell to 211.6, which was up 8.8% from August 2021.

Over the last two weeks, Manheim Market Report (MMR) prices saw higher-than-normal and consistent declines resulting in a 1.2% cumulative decline in the Three-Year-Old MMR Index, which represents the largest model-year cohort at auction.

According to Manheim, all major market segments saw seasonally adjusted prices, which were higher year-over-year in the first half of August. Vans posted the largest increase at 14.5%, while both non-luxury car segments outpaced the overall industry in seasonally adjusted year-over-year gains. Compared to July, all major segments saw price declines, with SUVs and pickups down the most and vans and compact cars down the least.

KPI — August 2022: Recent Vehicle Recalls

Key Performance Indicators Report — August 2022