KPI — August 2021: Consumer Trends

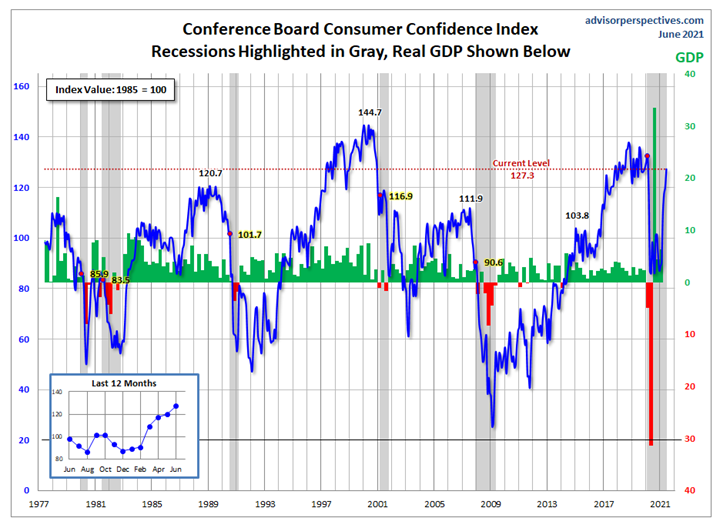

Consumers remain cautiously optimistic as they cope with inflation, but set their sights on economic recovery. The Conference Board Consumer Confidence Index® was relatively unchanged in July, following gains in each of the prior five months. The Index now stands at 129.1 (1985=100), up from 128.9 in June.

“Consumer confidence was flat in July but remains at its highest level since February 2020 (132.6),” said Lynn Franco, senior director of economic indicators at The Conference Board. “Consumers’ appraisal of present-day conditions held steady, suggesting economic growth in Q3 is off to a strong start. Consumers’ optimism about the short-term outlook didn’t waver, and they continued to expect that business conditions, jobs and personal financial prospects will improve. Short-term inflation expectations eased slightly but remained elevated. Spending intentions picked up in July, with a larger percentage of consumers saying they planned to purchase homes, automobiles and major appliances in the coming months. Thus, consumer spending should continue to support robust economic growth in the second half of 2021.”

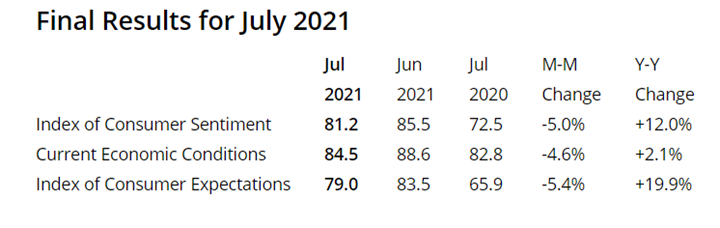

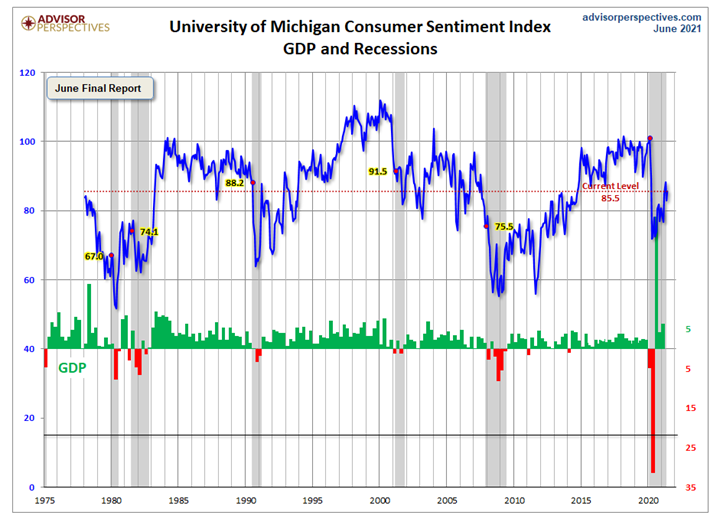

On the contrary, The Consumer Sentiment Index – a survey consisting of approximately 50 core questions that cover consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – finished at 81.2 in July, the lowest reading in five months.

While consumer sentiment edged upward near the end of July, it still posted a monthly decline of 5%, according to the most recent Michigan Survey of Consumers. The most substantial monthly declines were concentrated in the outlook for the national economy and complaints about high prices for homes, vehicles and household durables.

“In my view, the current degree of inflation is unlikely to persist beyond the next 12 months or so, consistent with the Fed’s ‘transitory’ characterization. Inflation is expected to peak in the coming months as many of the drivers of the recent acceleration in prices fade away,” said Jack Kleinhenz, NRF chief economist. “However, the exact timing and magnitude is more uncertain due to supply constraints on goods. Consequently, I am keeping a close eye on actual prices and household expectations as they relate to the current outlook for spending. Nonetheless, with the Fed’s adoption of ‘average inflation targeting’ that makes 2% inflation a longer-term goal but not an upper limit, it is likely that monetary policy will be geared toward letting inflation be reasonably above that level for a period of time,” he added.

Jill Mislinski of Advisor Perspectives – a leading interactive publisher for Registered Investment Advisors (RIAs), wealth managers and financial advisors – put the recent consumer sentiment report into larger historical context as a coincident indicator of the economy. “Toward this end, we have highlighted recessions and included GDP. The regression through the index data shows the long-term trend and highlights the extreme volatility of this indicator. Statisticians may assign little significance to a regression through this sort of data. But the slope resembles the regression trend for real GDP shown below, and it is a more revealing gauge of relative confidence than the 1985 level of 100 that the Conference Board cites as a point of reference,” said Mislinski.”

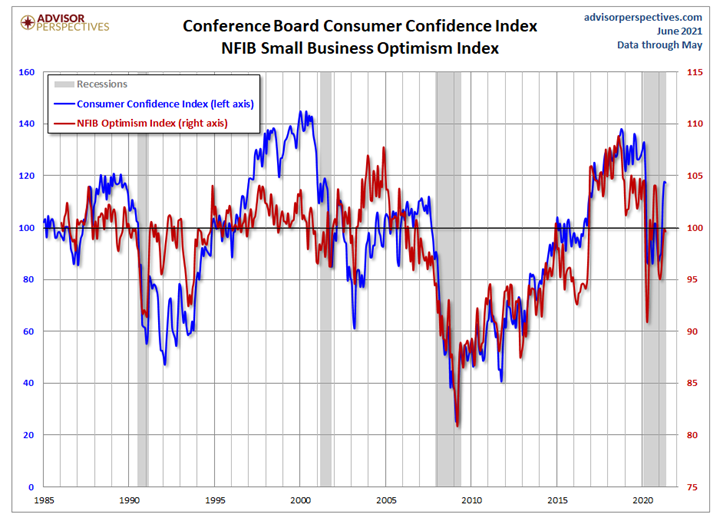

This chart provides additional perspectives about consumer attitudes, according to Advisor Perspectives.

Presented above is the correlation between consumer confidence and small business sentiment, the latter by way of the National Federation of Independent Business (NFIB) Small Business Optimism Index. As the chart illustrates, the two have tracked one another fairly closely since the onset of the Financial Crisis, although a spread appears infrequently, with the most recent one showing up 2015 through present, explained Mislinski.

Consumer Spending

According to NRF, consumer spending in June points to a recovering economy. Department, clothing and electronic stores all posted steep declines during the pandemic but are rebounding faster compared to other retail sectors over the last few months, explained Kleinhenz, who anticipates back-to-school shopping will positively impact retail sales.

NRF’s consumer survey estimates that combined K-12 and college sales will increase approximately 6% over last year. As of now, with retail sales up 16.4% the first half of the year, NRF’s revised forecast is on target. 2021 sales should grow between 10.5%-13.5% over 2020. – NRF

While retail spending was strong in June, there was a pullback in mid-July, according to the University of Michigan Consumer Sentiment Index which declined from 85.5 to 80.8 month-over-month. The rise in gasoline prices have sparked inflation concerns. Likewise, fears surrounding the delta variant of COVID-19 are likely weighing on confidence as well, stated Kleinhenz.

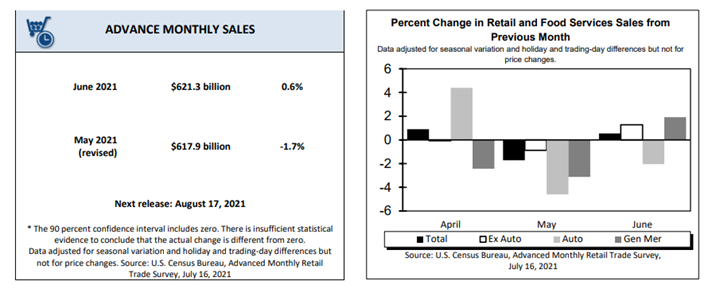

Advance estimates of U.S. retail and food services sales for June 2021 – adjusted for seasonal variation and holiday and trading-day differences, but not for price changes – were $621.3 billion, an increase of .6% (±.5%) from the previous month, and 18% (±.7%) above June 2020. Total sales for the April 2021 through June 2021 period were up 31.5% (±.5%) from the same period a year ago. The April 2021 to May 2021 percent change was revised from down 1.3% (±.5%) to down 1.7% (±.3%). Retail trade sales were up .3% (±.5%)* from May 2021 and up 15.6% (±.7%) above last year. Clothing and clothing accessories stores were up 47.1% (±2.8%) from June 2020, while food services and drinking places were up 40.2% (±3%) from last year.

Key Performance Indicators Report — August 2021