- KPI – April 2025: Consumer Trends

- KPI – April 2025: State of Manufacturing

- KPI – April 2025: State of Business – Automotive Industry

- KPI – April 2025: State of the Economy

- KPI – April 2025: Recent Vehicle Recalls

This month, economic data amounts to a mixed bag of results. On one hand, consumers are clearly on edge – as evident in the most recent confidence and sentiment surveys. Likewise, many families continue to shoulder burdensome costs, from housing and utility rates to rising insurance and groceries.

Though future labor, financial, trade and manufacturing impacts remain uncertain, the U.S. is currently holding the line – with some key data points even looking bright.

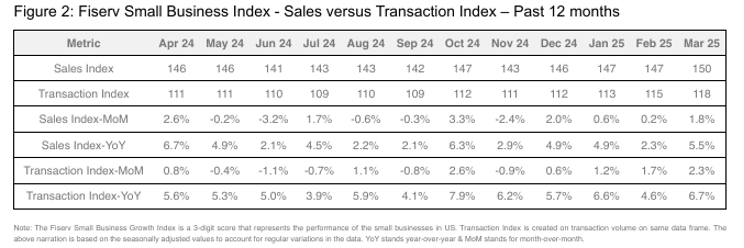

The seasonally adjusted Fiserv Small Business Index registered 150.1 in March 2025, an increase of 1.8% month-over-month and up 5.5% year-over-year. Similarly, the Fiserv Small Business Transaction Index climbed to 117.6, with growth of 2.3% month-over-month and 6.7% year-over-year expansion.

This data indicates a positive trend in both sales and transactions for small businesses across the U.S.

Key takeaways, courtesy of the Fiserv Small Business Sales Index:

- The Fiserv Small Business Sales Index for Goods recorded a 3.8% year-over-year increase, maintaining a steady growth trend observed over the past months. Similarly, the Services sector experienced a 6.2% year-over-year increase in the Fiserv Small Business Sales Index, indicating stronger growth compared to Goods. The Fiserv Small Business Transaction Index for Goods posted a 3.7% year-over-year hike, while Services jumped 7.9% – highlighting a more significant expansion in transactions.

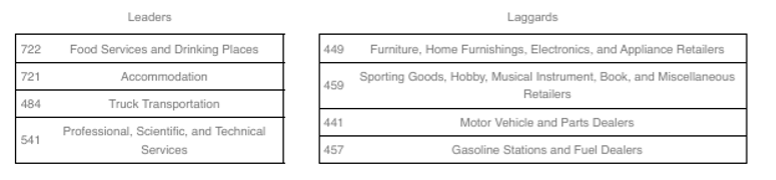

- Current data highlights diverse growth drivers across various industries. The Food Services and Drinking Places industry, despite a slight YoY sales dip of -0.6%, posted a strong month-over-month sales increase of 2.7%, with transactions surging by 7.9% year-over-year and 1.8% month-over-month. The Accommodation industry also contributed to growth, with a modest year-over-year sales decrease of -0.1% but a notable month-over-month sales jump of 3.8%. Truck Transportation displayed significant momentum with an 11.4% year-over-year and a 4.5% month-over-month sales increase, alongside a 14.4% year-over-year and 5.6% month-over-month rise in transactions. The Professional, Scientific and Technical Services industry saw an 11.5% year-over-year and 1.4% month-over-month sales growth.

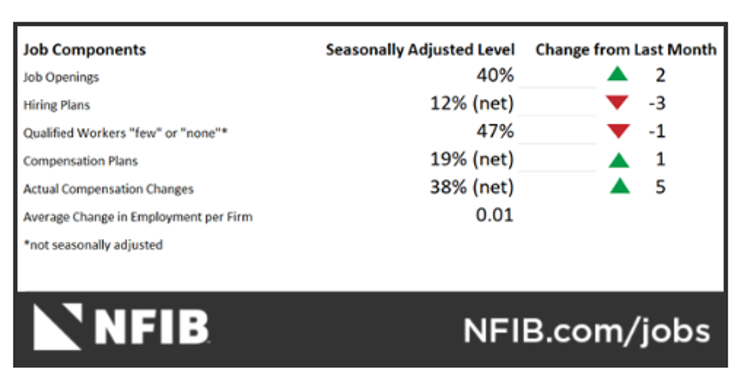

At 97.4, the NFIB Small Business Optimism Index declined by 3.3 points month-over-month. Alongside inflation and hiring concerns, the percentage of small business owners reporting taxes as their single most important problem rose 2 points from February to 18%. For context, the number of owners reporting “taxes” as their top small business issue has not been this high since November 2021.

“The implementation of new policy priorities has heightened the level of uncertainty among small business owners over the past few months,” says Bill Dunkelberg, NFIB chief economist. “Small business owners have scaled back expectations on sales growth as they better understand how these rearrangements might impact them.”

Important takeaways, courtesy of NFIB:

- The net percentage of owners expecting better business conditions fell 16 points from February to a net 21% (seasonally adjusted). This is the third consecutive monthly decline and the largest monthly decline since December 2020.

- The net percentage of owners expecting higher real sales volumes fell 11 points from February to a net 3% (seasonally adjusted). This is the third consecutive month real sales expectations declined after surging from recession levels after the election.

- The net percentage of owners raising average selling prices fell six points from February to a net 26% seasonally adjusted. This is the largest monthly decrease since December 2022, but still historically high.

- Seasonally adjusted, a net 30% plan price hikes in March, up 1 point from February and the highest reading since March 2024.

- Overall, 53% of small business owners reported hiring or trying to hire in March, unchanged from February. Also, 47% (87% of those hiring or trying to hire) of owners reported few or no qualified applicants for the positions they were trying to fill., while 26% of owners reported few qualified applicants for their open positions and 21% reported none.

Image Source: NFIB Small Business Optimism Index

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends. Below are a few key data points explained in further detail throughout the report.

Key data points:

Economic activity in the manufacturing sector contracted in March, following two consecutive months of expansion preceded by 26 straight months of contraction, say the nation’s supply executives in the latest Manufacturing ISM Report On Business. The Manufacturing PMI registered 49% in March, 1.3 percentage points lower compared to 50.3% in February. The overall economy continued expanding for the 59th month, following one month of contraction in April 2020.

In March, the Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.1% on a seasonally adjusted basis after rising 0.2% in February, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 2.4% before seasonal adjustment.

Total new vehicle sales for April 2025, including retail and non-retail transactions, are projected to reach 1,519,900 – a 10.5% year-over-year increase, according to a joint forecast from J.D. Power and GlobalData.

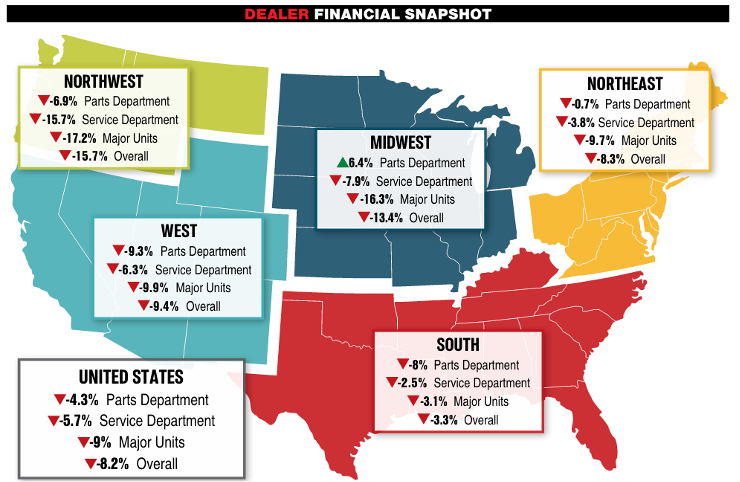

Powersports Business says dealers across the country reported an overall combined revenue decline of 8.2% year-over-year in February, according to composite data from more than 1,700 dealerships in the U.S. that utilize CDK Lightspeed DMS. On average, dealerships were down 9% in major units, 5.7% in service and 4.3% in parts.

Image Source: Powersports Business