- KPI – April 2025: The Brief

- KPI – April 2025: Recent Vehicle Recalls

- KPI – April 2025: State of Business – Automotive Industry

- KPI – April 2025: State of the Economy

- KPI – April 2025: Consumer Trends

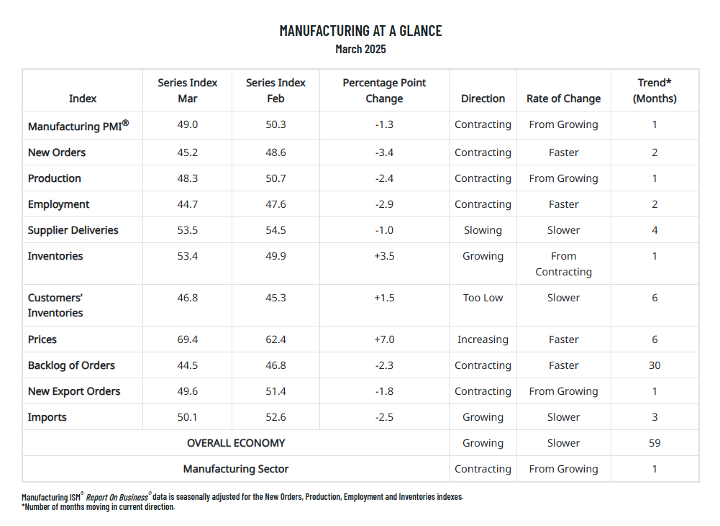

Economic activity in the manufacturing sector contracted in March, following two consecutive months of expansion preceded by 26 straight months of contraction, say the nation’s supply executives in the latest Manufacturing ISM Report On Business. The Manufacturing PMI registered 49% in March, 1.3 percentage points lower compared to 50.3% in February. The overall economy continued expanding for the 59th month after one month of contraction in April 2020.

“Demand and production retreated and de-staffing continued, as panelists’ companies responded to demand confusion. Prices growth accelerated due to tariffs, causing new order placement backlogs, supplier delivery slowdowns and manufacturing inventory growth,” says Timothy R. Fiore, CPSM, C.P.M., chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee.

Data shows 46% of manufacturing gross domestic product (GDP) contracted in March, up from 24% in February. The share of manufacturing sector GDP registering a composite PMI calculation at or below 45% (a good barometer of overall manufacturing weakness) was 7% in March, a 5-percentage-point increase compared to the 2% reported a month prior.

Important takeaways, courtesy of the Manufacturing ISM Report On Business:

- Indications that demand weakened include: the (1) New Orders Index falling further into contraction territory, (2) New Export Orders Index dropping into contraction, (3) Backlog of Orders Index contracting at a faster rate, and (4) Customers’ Inventories Index remaining in “too low” territory.

- Output (measured by the Production and Employment indexes) also weakened. Factory output (production) contracted in March, indicating that panelists’ companies are revising production plans downward in the face of economic headwinds.

- The Employment Index moved deeper into contraction, as panelists’ companies continued to release workers. Companies continued to cite “attriting down” as the best process, as opposed to layoffs.

- Inputs – defined as supplier deliveries, inventories, prices and imports – expanded.

According to the Manufacturing ISM Report On Business, all four indexes indicated expansion, a downside when demand is moving in the opposite direction. Strategists say inventories growth is a temporary move to avoid tariffs and will decline when trade issues are resolved.

What respondents are saying, according to the Manufacturing ISM Report On Business:

“Complex markets saw a surge in volume buying in anticipation of 2025 being slightly better than 2024. In March, however, all markets saw a slowdown, with fear and inventory stocking to hold through a potential crisis.” [Chemical Products]

“Acute shortages continue to impact supply chain continuity. Chinese restrictions on critical minerals such as germanium have caused major shortages, resulting in all supply needed in 2025 already assumed — and, not surprisingly, significant price increases as a result. Tariffs are causing minor ripples at the moment in securing supply, with purchase order terms narrowing due to uncertainties. A&D (aerospace and defense), which has been very resilient, is starting to see questionable medium- to long-term demand due to governmental policy, including retaliatory actions taken by foreign countries with foreign military sales.” [Transportation Equipment]

“Customers are pulling in orders due to anxiety about continued tariffs and pricing pressures.” [Computer & Electronic Products]

“Starting to see slower-than-normal sales in Canada and concerns of Canadians boycotting U.S. products could become a reality.” [Food, Beverage & Tobacco Products]

“Business conditions are deteriorating at a fast pace. Tariffs and economic uncertainty are making the current business environment challenging.” [Machinery]

“New order levels have increased and are better than expected. We suspect that our customers are trying to build inventory at current prices to get ahead of expected tariff and related cost increases. We expect this surge in demand to be short-lived.” [Fabricated Metal Products]

“Demand has been stable, consistent with last year. No evidence of growing demand. Tariff impacts and mitigation strategies are a daily conversation.” [Electrical Equipment, Appliances & Components]

“Newly implemented tariffs are significantly impacting gross profits. Canada’s new tariffs on U.S. goods are significantly impacting orders from that country. Quotes and sales are lower from Europe due to the threat of retaliatory tariffs.” [Miscellaneous Manufacturing]

“Worldwide economic instability has really begun to impact our oil and gas business. Aside from the change in the U.S. administration, the economies of China, India and Europe are drivers in what we believe is the next cyclical trough.” [Petroleum & Coal Products]

“Bearish market sentiment and tariff applications and costs have dominated discussions over the past month and should continue to dominate markets until a clear path forward is determined. Overall concern is whether or not demand destruction will occur with higher pricing.” [Primary Metals]