KPI – April 2025: State of Business – Automotive Industry

Sponsored by Holley Performance Brands

- KPI – April 2025: The Brief

- KPI – April 2025: State of Manufacturing

- KPI – April 2025: Consumer Trends

- KPI – April 2025: State of the Economy

- KPI – April 2025: Recent Vehicle Recalls

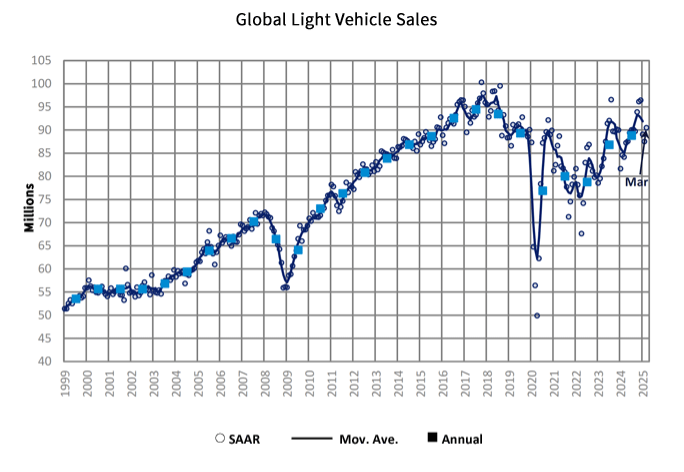

Global Light Vehicle Sales

In March, the Global Light Vehicle (LV) selling rate hit 90 million units per year, an improvement compared to the previous month. The market increased 7% year-over-year and 6% year-to-date, though economists warn “clouds are gathering over the global economic outlook.”

Key markets like the U.S., China and Western Europe experienced growth; however, U.S. protectionist policy and related uncertainty are expected to have tangible impacts on the global economic landscape in 2025 and beyond, according to GlobalData.

In the U.S., there was a clear “pull-forward effect” related to looming price hikes due to tariffs on automobiles. Sales will remain steady in China thanks to stimulus measures implemented by the Chinese government.

April sales are expected to increase right under 5% year-over-year. With most manufacturers keeping U.S. pricing unchanged for now – and, in some cases, even offering discounts – sales are expected to be robust. China is expected to post year-over-year growth as well, but Japan is forecast to see merely modest gains. The global selling rate is expected to reach 90.6 million units, up from 87.2 million units year-over-year.

“The emerging trade war has the potential to slow economic growth globally, affecting auto sales. Although the full details are yet to emerge – and a recent 90-day pause in U.S. reciprocal tariffs offers some hope that the worst-case scenario could be averted – we have cut our global 2025 sales forecast to 89.5 million units,” says David Oakley, manager of Americas vehicle sales forecasts at GlobalData.

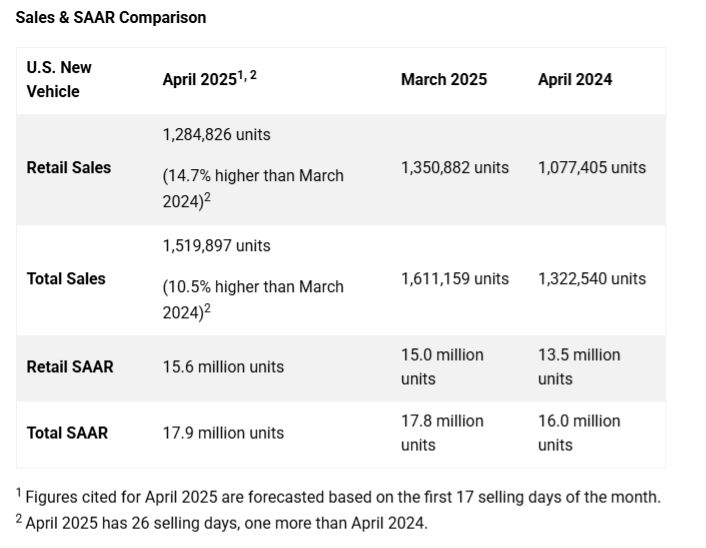

U.S. New Vehicle Market

Total new-vehicle sales for April 2025, including retail and non-retail transactions, are projected to reach 1,519,900 – a 10.5% year-over-year increase, according to a joint forecast from J.D. Power and GlobalData.

“April results are dominated by the prospect of future vehicle price increases due to tariffs. Beginning at the end of March, and continuing through April, consumers have been accelerating their vehicle purchases under the expectation that prices will rise soon. In fact, an extra 83,000 sales in March and 139,000 in April have occurred due to accelerated vehicle purchases,” says Thomas King, president of the data and analytics division at J.D. Power.

However, as multiple manufacturers have committed to keep MSRPs stable through the early summer months, and uncertainty about tariffs in general persists, he says the rush to dealer showrooms has slowed significantly. During the first week of April, for example, the sales pace was 28% above normal levels, but by the third week the numbers hovered at +6%.

“In showrooms, shoppers are finding deals that are comparable to recent months, although discounts from manufacturers and dealers have moderated slightly,” King adds.

Key takeaways, courtesy of J.D. Power:

- Retail buyers are on pace to spend $55.8 billion on new vehicles, up $9.8 billion year-over-year.

- Internal combustion engine (ICE) vehicles are projected to account for 76.1% of new vehicle retail sales, a decrease of 3.8% from a year ago. Hybrid electric vehicle (HEV) and plug-in hybrid vehicle (PHEV) sales are expected to reach 12.6% (an increase of 2.9% year-over-year) and 2.3% (a gain of 0.4% year-over-year). Electric vehicles (EV) are on pace to account for 8.7% of sales, up 0.2% from a year ago.

- Trucks/SUVs represent 82.1% of new vehicle retail sales, up 2.5% year-over-year.

- Leasing is expected to account for 20.6% of sales this month, down 3.2% from a year ago.

- Fleet sales are estimated to total 235,071 units in April, down 7.8% year-over-year. Fleet volume is expected to account for 15.5% of total light-vehicle sales, down 3.1% year-over-year.

- The average new vehicle retail transaction price is expected to reach $45,764, up $887 year-over-year.

- Average incentive spending per unit is expected to reach $2,808, up $209 year-over-year. Spending as a percentage of the average MSRP is expected to increase to 5.6%, up 0.3% year-over-year.

- Average monthly finance payments are on pace to hit $742, up $19 year-over-year. The average interest rate for new-vehicle loans is 6.8%, down 0.18 percentage points from a year ago.

- Total retailer profit per unit, which includes vehicle gross plus finance and insurance income, is expected to be $2,525, similar to April 2024 but up $361 from March. Total aggregate retailer profit from new-vehicle sales for this month is projected to be $3.1 billion, up 18.8% year-over-year.

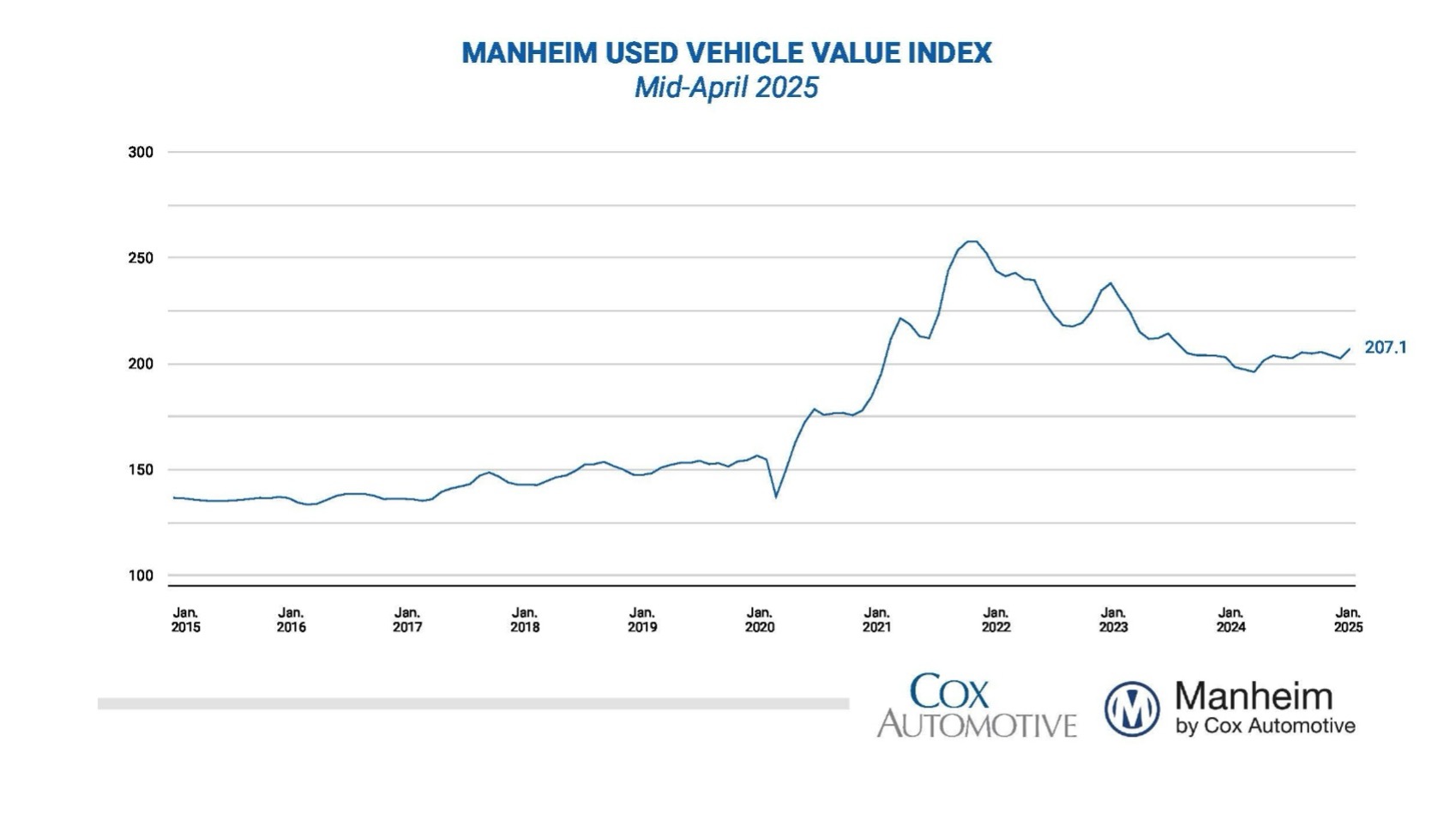

U.S. Used Market

Wholesale used-vehicle prices (on a mix-, mileage- and seasonally adjusted basis) increased sharply from March during the first 15 days of April. The mid-month Manheim Used Vehicle Value Index increased to 207.1 – showing a rise of 4.3% from the full month of April 2024, with the seasonal adjustment dampening the non-adjusted price increase.

“Wholesale markets were not as strong as usual in March, but they turned on a dime the last week of the month and into early April as tariffs were implemented,” says Jeremy Robb, senior director of economic and industry insights at Cox Automotive. “In the first two weeks of April, we’ve seen much stronger sales conversion and pricing trends at Manheim, as dealers look to replenish inventory on the back of higher used retail demand. Valuation trends are likely to stay elevated through Q2 relative to normal, but appreciation trends in the second week of the month were not quite as strong as the first, so the frenzy could already have peaked. With the volatility in the financial markets, it’s not surprising to see some impact on the consumer’s appetite.”

According to Manheim, most major market segments posted positive results for seasonally adjusted prices in the first half of April. The overall industry increased 2.2% above the prior month. Midsize cars, SUVs, trucks, compact cars and luxury were up 2.3%, 2%, 1.9%, 1.5% and 0.2%, respectively.

Compared to the industry’s year-over-year increase of 4.3%, the SUV, luxury and truck segments swelled 5.1%, 4.7% and 2.3%, respectively. Midsize and compact cars posted subpar results at +0.9% and -0.08%, respectively. The EV segment was up 0.6%.

“So far in April, average used vehicle retail prices are $28,725, up $200 from a year ago. Trade-in equity is trending towards $8,313, which is up $328 from a year ago,” King says.