- KPI – April 2025: The Brief

- KPI – April 2025: State of Manufacturing

- KPI – April 2025: State of Business – Automotive Industry

- KPI – April 2025: State of the Economy

- KPI – April 2025: Recent Vehicle Recalls

Below is a synopsis of consumer confidence, sentiment, demand and income/spending trends.

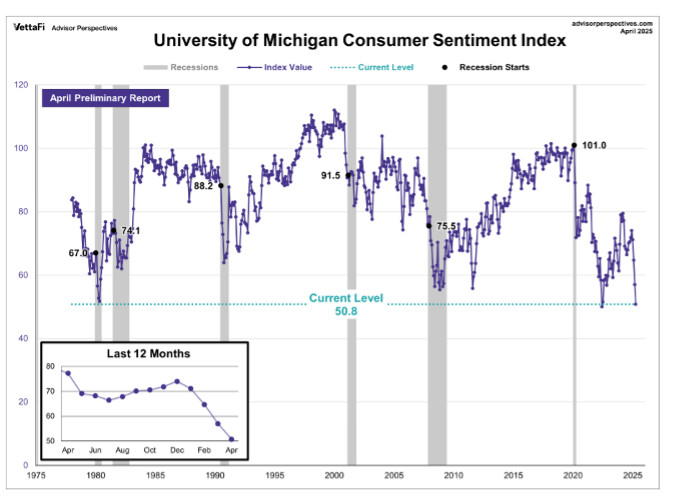

The University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situations, buying attitudes and overall economic conditions – registered 57% in March and posted a preliminary reading of 50.8% in April. The current standing is the second-lowest reading on record, surpassed only by June 2022.

In all, consumer sentiment dropped 10.9% this month and more than 30% since December 2024 due to escalating concerns about trade wars, inflation, business conditions, personal finances, income and the labor market, according to Joanne Hsu, director of Survey of Consumers. The findings are “pervasive and unanimous” across age, income, education, geographic region and political affiliation.

“The share of consumers expecting unemployment to rise in the year ahead increased for the fifth consecutive month and is now more than double the November 2024 reading and the highest since 2009. This lack of labor market confidence lies in sharp contrast to the past several years, when robust spending was supported primarily by strong labor markets and incomes,” she says.

Year-ahead inflation expectations surged from 5% last month to 6.7% this month, the highest reading since 1981 and marking four consecutive months of unusually large increases of 0.5 percentage points or more. Data shows this month’s rise was prevalent across all three political affiliations. Long-run inflation expectations climbed from 4.1% in March to 4.4% in April, reflecting a particularly large jump among independents.

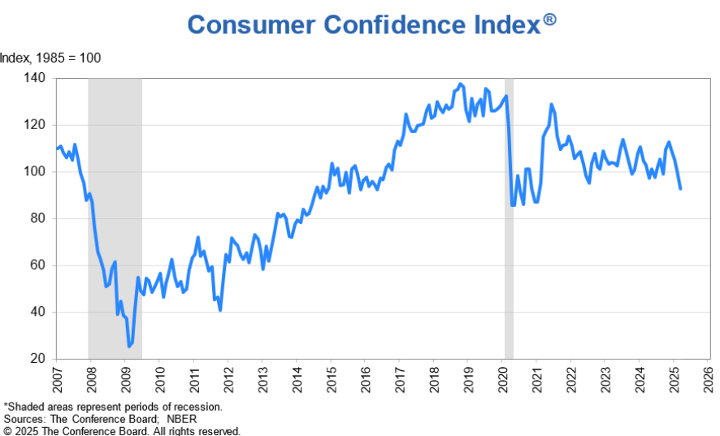

Similarly, the Conference Board Consumer Confidence Index fell by 7.2 points to 92.9 (1985 = 100) in March. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – decreased 3.6 points to 134.5. The Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – dropped 9.6 points to 65.2, the lowest level in 12 years and well below the threshold of 80, which usually signals a recession ahead.

“Consumer confidence declined for a fourth consecutive month in March, falling below the relatively narrow range that had prevailed since 2022,” says Stephanie Guichard, senior economist of global indicators at The Conference Board. “Of the Index’s five components, only consumers’ assessment of present labor market conditions improved, albeit slightly. Views of current business conditions weakened to close to neutral. Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects falling to a 12-year low.”

“Meanwhile, consumers’ optimism about future income, which had held up quite strongly in the past few months, largely vanished, suggesting worries about the economy and labor market have started to spread into consumers’ assessments of their personal situations,” she continues.

Data shows the fall in confidence was driven by consumers over 55 years old and, to a lesser extent, those between 35 and 55 years old. By contrast, Guichard says confidence rose slightly among consumers under 35, as an uptick in their assessments of the present situation more than offset gloomier expectations. The decline was also broad-based across income groups, with the only exception being households earning more than $125,000 a year.

Key takeaways, courtesy of the Conference Board:

- Consumers turned negative about the stock market for the first time since the end of 2023. In March, only 37.4% expected stock prices to rise over the year ahead – down nearly 10 percentage points from February and 20 percentage points from the high reached in November 2024. On the flip side, 44.5% expected stock prices to decline (up 11 ppts from February and over 22 ppts more than November 2024).

- On a six-month moving average basis, purchasing plans for both homes and cars declined. Surprisingly, intentions to buy big-ticket items like appliances and electronics ticked up, which may reflect plans to buy before impending tariffs lead to price increases. Consumers’ overall intentions to purchase additional services in the months ahead were little changed, but their priorities shifted. Fewer consumers planned to spend more on movies and live entertainment or sports, and more planned to spend on outdoor activities and travel. Vacation plans also increased.

- Consumers’ views of their Family’s Current Financial Situation improved slightly, but their expectations for future finances declined to the lowest level since July 2022.

- Average 12-month inflation expectations rose from 5.8% in February to 6.2% in March, with consumers expressing concern about high prices for key household staples like eggs and the impact of tariffs.

- The proportion of consumers anticipating a recession over the next 12 months remained steady at a nine-month high.

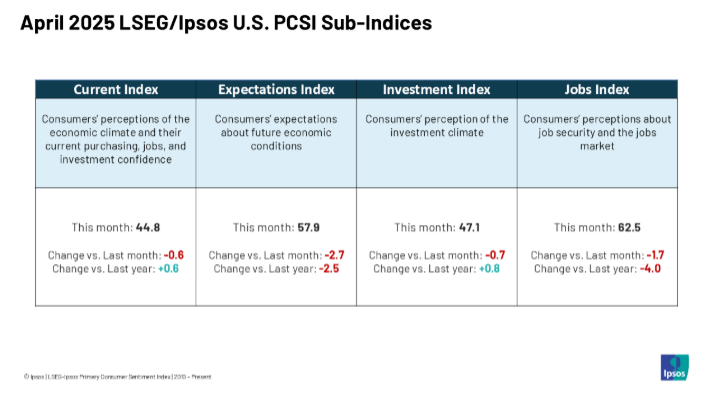

Caption: Some key data points in The University of Michigan Survey of Consumers and the Conference Board sentiment and confidence indexes do not align with the April 2025 LSEG/Ipsos Primary Consumer Sentiment Index | Ipsos, The Employment Trends Index (ETI) and the Fiserv Small Business Index. Readers are encouraged to review all available data sources to ensure comprehensive and impartial representation.

Consumer Income & Spending

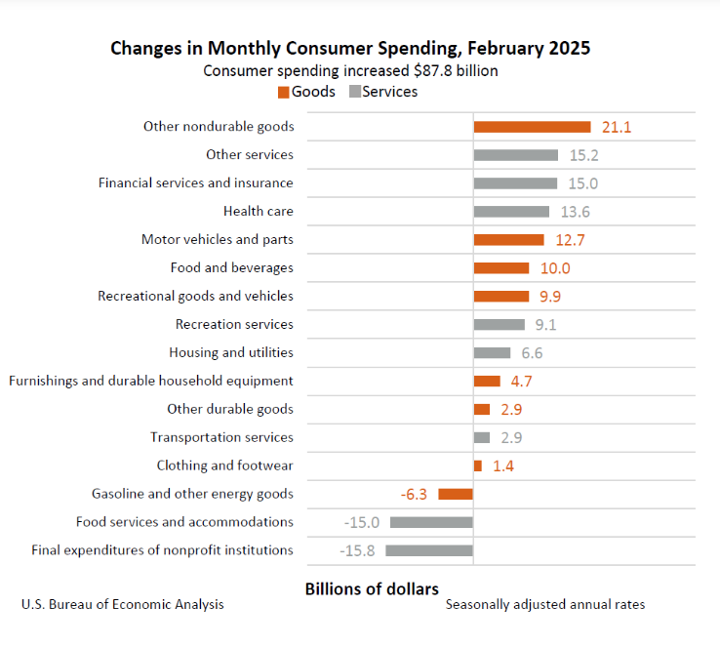

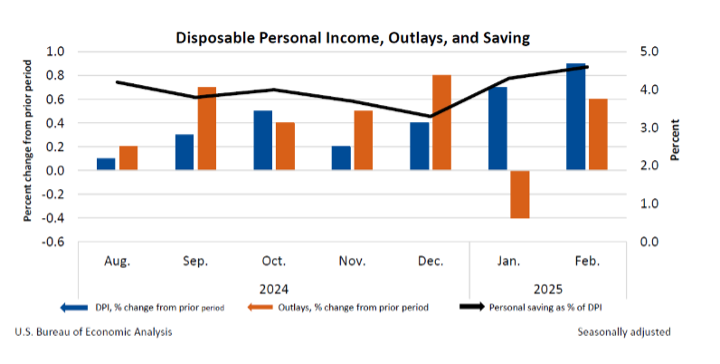

According to the U.S. Bureau of Economic Analysis (BEA), in February 2025 personal income increased $194.7 billion (0.8% at a monthly rate). Disposable personal income (DPI) – personal income less personal current taxes – increased $191.6 billion (0.9%) and personal consumption expenditures (PCE) increased $87.8 billion (0.4%).

Personal outlays – the sum of PCE, personal interest payments and personal current transfer payments –increased $118.4 billion in February. Personal saving was $1.02 trillion, while the personal saving rate –personal saving as a percentage of disposable personal income – registered 4.6%.

Important takeaways, courtesy of BEA:

- In February, the $87.8 billion increase in current-dollar PCE reflected increases of $56.3 billion in spending for goods and $31.5 billion in spending for services.

- Compared to the preceding month, the PCE price index increased 0.3%. Excluding food and energy, the PCE price index increased 0.4%.

- The PCE price index increased 2.5% year-over-year. Excluding food and energy, the PCE price index increased 2.8% from one year ago.