KPI – April: 2024: Recent Vehicle Recalls

KPI – April 2024: State of Business – Automotive industry

KPI – April 2024: State of Manufacturing

KPI – April 2024: Consumer Trends

State of the Economy

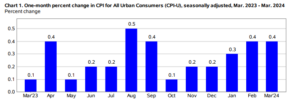

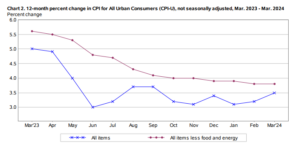

In March, the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4% on a seasonally-adjusted basis, says the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 3.5% before seasonal adjustment.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- The indexes for shelter and gasoline rose. Combined, they contributed over half of the monthly all-items increase. The energy index rose 1.1% month-over-month. The food and food-away-from home indexes inched up 0.1% and 0.3%, respectively, while the food-at-home index was unchanged.

- Indexes on the incline include shelter, motor vehicle insurance, medical care, apparel and personal care. The indexes for used cars and trucks, recreation and new vehicles were among those to decrease month-over-month.

- The all-items index rose 3.5% year-over-year, with the all items less food and energy index increasing 3.8%. Of significance, the energy index jumped 2.1% – its first 12-month increase since the period ending February 2023. In addition, the food index increased 2.2% year-over-year.

Employment

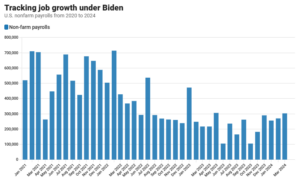

Total nonfarm payroll employment rose by 303,000 in March – outpacing the Dow Jones estimate of 200,000.

The unemployment rate and number of unemployed persons were relatively unchanged at 3.8% and 6.4 million people, respectively. The labor force participation rate and the long-term unemployed (those jobless for 27 weeks or more) edged up to 62.7% and 19.5%, respectively, according to the U.S. Bureau of Labor Statistics. In addition, wages rose 0.3% compared to last month and 4.1% year-over-year – both in line with Wall Street estimates.

“The March jobs report illustrates the exceptional resilience in the labor economy – one in which conditions are tight and job creation remains strong,” says Jim Baird, CIO at Plante Morgan Financial Advisors. “The labor market has come off the boil of a few years ago, but remains on a very solid footing.”

Positive gains have kept unemployment below 4% since January 2022, though CNBC reports some cracks in the armor. Overall, gains tilted heavily to part-time workers in the household survey, which is used to calculate the unemployment rate. Full-time workers fell by 6,000, while part-timers increased by 691,000. Multiple job holders jumped by 217,000, encompassing 5.2% of the total employment level.

While key economic indicators continue to move in the right direction, business professionals and consumers alike are concerned with unprecedented government spending, geopolitical tensions, persistent inflation and high borrowing costs – all of which have a collective impact on broader economic health.

“I think it’s a mistake to assume that everything’s hunky-dory,” says Jamie Dimon, JPMorgan Chase CEO. “[In general], when stock markets are up, it’s kind of like this little drug we all feel like it’s just great. But remember, we’ve had so much fiscal monetary stimulation, so I’m a little more on the cautious side.”

By Demographic

This month, unemployment rates among the major worker groups: adult women – 3.6%, adult men 3.3%, teenagers – 12.6%, Asians 2.5%, Whites – 3.4%, Hispanics 4.5% and Blacks – 6.4%.

Last month, unemployment rates among the major worker groups: adult women – 3.5%, adult men – 3.5%, teenagers – 12.5%, Asians – 3.4%, Whites – 3.4%, Hispanics – 5% and Blacks – 5.6%.

Caption: In March 2024, the national unemployment level of the U.S. stood at approximately 6.43 million unemployed persons. Seasonal adjustment is a statistical method for removing the seasonal component of a time series that is used when analyzing non-seasonal trends.

By Industry

In March, the largest job gains occurred in health care, government, as well as leisure and hospitality. These three sectors accounted for 192,000 of the 303,000 reported gains.

“While two-thirds of March’s payroll additions were in the three sectors seeing acute labor shortages (healthcare and social assistance, leisure and hospitality, and government), job gains broadened for the fourth straight month, with increases in construction, other services and retail trade. These continued payroll gains outside of the major labor shortage-threatened industries point towards a resilient overall labor

market,” says Will Baltrus, associate economist at The Conference Board.

In addition, he notes the number of temporary employees – a component of ETI and a strong leading indicator for employment – was little changed in March, suggesting few-to-no layoffs in the near term.

“Looking ahead, we continue to project slower real GDP growth in Q2 and Q3, which may spill over into decreases in hiring – but this pressure will be limited by labor supply factors like an aging workforce in some sectors and coincident labor shortages in others,” Baltrus says.

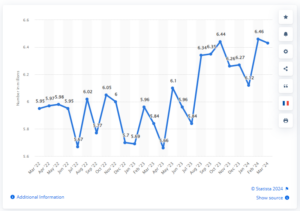

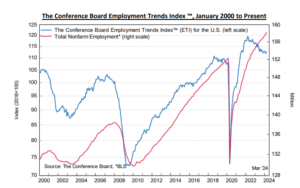

Caption: The Conference Board Employment Trends Index™ (ETI) increased in March to 112.84,

up from a downwardly revised 111.85 in February. The Employment Trends Index is a leading composite index for employment. When the Index increases, employment is likely to grow as well, and vice versa. Turning points in the Index indicate that a change in the trend of job gains or losses is about to occur in the coming months.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- Employment in the other services industry continued its upward trend in March (+16,000). The industry added an average of 8,000 jobs per month over the past 12 months; however, employment in other services remains below its February 2020 level by 40,000, or 0.7%.

- Employment in social assistance continued to trend up in March (+9,000), below the average monthly gain of 22,000 over the past 12 months.

- In March, employment was little changed in retail trade (+18,000). A job gain in general merchandise retailers (+20,000) was partially offset by job losses in building material and garden equipment and supplies dealers (-10,000), as well as in automotive parts, accessories and tire retailers (-3,000).

Click here to review more employment details.