KPI — April 2023: State of the Economy

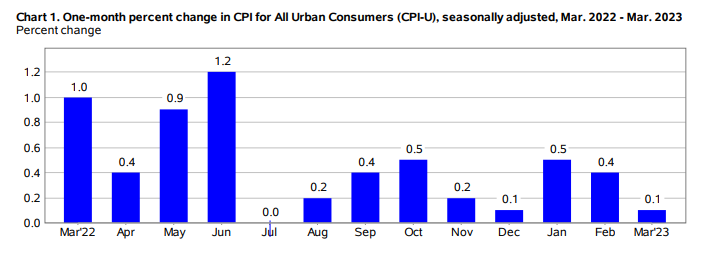

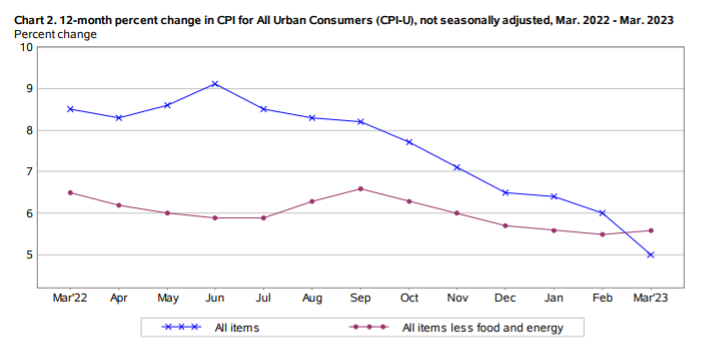

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1% in March on a seasonally-adjusted basis, says the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 5% before seasonal adjustment.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- Categories on the rise in March include shelter, motor vehicle insurance, airline fares, household furnishings and operations, as well as new vehicles. The indexes for used cars and trucks and medical care declined month-over-month.

- The all-items index increased 5% year-over-year and 5.6% less food and energy. The energy index decreased 6.4% year-over-year, while food increased 8.5%.

Employment

In March, the unemployment rate and number of unemployed persons remained relatively unchanged at 3.5% and 5.8 million, respectively, according to the U.S. Bureau of Labor Statistics. Similarly, the labor force participation rate was 62.6%, with the long-term unemployed (those jobless for 27 weeks or more) accounting for 18.9% of the total unemployed.

“The labor market in March came in like a lion with a banking crisis and more layoffs, and is going out like a lamb with a solid jobs report. The labor market is still strong, but it’s gliding slowly back down to Earth,” admits Daniel Zhao, Glassdoor’s lead economist.

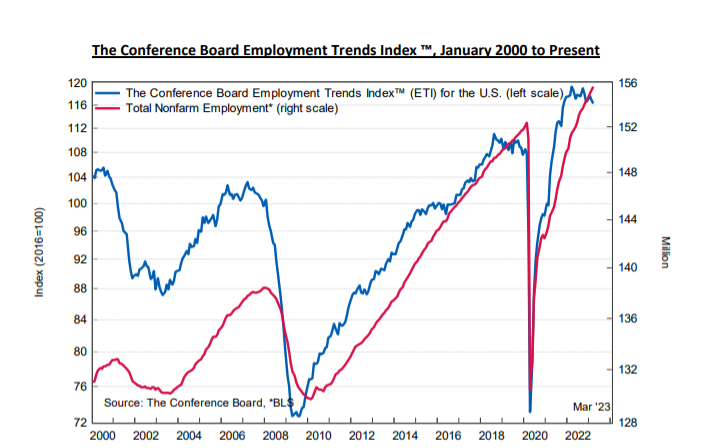

Overall, the economy continues to add jobs in industries where labor shortages remain, plus wage growth is above its pre-pandemic rate, explains Selcuk Eren, senior economist at The Conference Board. The Federal Reserve is expected to raise interest rates two more times by 25 basis points each in order to bring wage growth and inflation under control. Eren expects the move to trigger job losses and increase unemployment in the second half of 2023, as well as early 2024.

The Conference Board Employment Trends Index™ (ETI) declined in March to 116.24, down from a downwardly revised 116.75 in February 2023. The Employment Trends Index is a leading composite index for employment. When the index increases, employment is likely to grow as well, and vice versa. Turning points in the index indicate that a turning point in the number of jobs is about to occur in the coming months.

By Demographic

This month, unemployment rates among the major worker groups: adult women – 3.1%, adult men – 3.4%, teenagers – 9.8%, Asian – 2.8%, White – 3.2%, Hispanic – 4.6% and Black – 5%.

Last month, unemployment rates among the major worker groups: adult women – 3.2%, adult men – 3.3%, teenagers – 11.1%, White – 3.2%, Asian – 3.4%, Hispanic – 5.3% and Black – 5.7%.

Monthly unemployment rate in the U.S. from March 2021 to March 2023 (seasonally-adjusted).

By Industry

Total nonfarm payroll employment rose by 236,000 in March, compared with the average monthly gain of 334,000 during the past six months. According to current data, job growth continued to trend up in leisure and hospitality, government, professional and business services, and health care.

“The labor market remains tight although it has cooled down somewhat from a year ago,” Eren says. “On the demand side, the job openings rate is still well above the pre-pandemic trend but is declining. On the supply side, the labor force continues to grow and reached 166.7 million in March, as a result of rising labor force participation and a rebound in immigration to its long-term trend. The labor-force participation rate for prime-age workers has climbed back to 83.1% – the same level as it was in February 2020.”

“We expect the economy will continue adding jobs in industries where employment has yet to fully recover from the pandemic, such as leisure and hospitality and government. Continued job growth is also likely in health care and social assistance, a reflection of our aging society,” he continues.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- Leisure and hospitality added 72,000 jobs in March, lower than the average monthly gain of 95,000 during the past six months. Most of the job growth occurred in food services and drinking places, where employment rose by 50,000. Employment in leisure and hospitality is below its pre-pandemic February 2020 level by 368,000, or 2.2%.

- Employment in professional and business services continued to trend up (+39,000). Within the industry, employment in professional, scientific and technical services continued its upward trend in March (+26,000).

- Over the month, health care added 34,000 jobs, lower than the recent average monthly gain of 54,000. In March, job growth occurred in home health care services (+15,000) and hospitals (+11,000). Employment continued to trend up in nursing and residential care facilities (+8,000).

Review all employment statistics here.

Eren says job growth in goods-producing industries – including manufacturing and construction – continues to slow (turning negative in March). In addition, employment is stagnant in transportation and warehousing, as well as in finance and insurance. The information services industry also cut jobs compared to job-growth highs posted in November.

“In the second quarter of 2023, we expect job gains in industries that are still adding jobs to offset losses in industries that have a negative outlook, resulting in continued slow job growth overall,” Eren says. “However, in the second half of 2023, we expect job losses to become more widespread as GDP growth turns negative, with the unemployment rate likely to rise to 4.5% by early 2024.”

KPI — April 2023: Consumer Trends

Key Performance Indicators Report — April 2023