KPI — April 2023: Consumer Trends

The Conference Board Consumer Confidence Index® increased slightly in March to 104.2 (1985=100), a small uptick from 103.4 in February. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – decreased to 151.1 (1985=100) from 153.0 last month. The Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – rose to 73.0 (1985=100) from 70.4 in February (a slight upward revision). During 12 of the last 13 months, however, the Expectations Index registered below 80 – a level which often signals a recession.

According to recent data, the gain reflects “a slightly improved outlook” for consumers under 55 years of age and for households earning $50,000 and over.

“While consumers feel a bit more confident about what’s ahead, they are slightly less optimistic about the current landscape,” says Ataman Ozyildirim, senior director of economics at The Conference Board. “The share of consumers saying jobs are ‘plentiful’ fell, while the share of those saying jobs are ‘not so plentiful’ rose. The latest results also reveal that their expectations of inflation over the next 12 months remain elevated – at 6.3%.”

Though overall purchasing plans for appliances continued to soften, automobile purchases experienced a slight bump. In addition, the business and research group also asked a new survey question about service industry spending during the next six months. Respondents noted they plan to spend less on activities such as gambling, amusement park and museum visits, travel and the movies. Meanwhile, the largest categories for spending increases include health care, household maintenance and car repair.

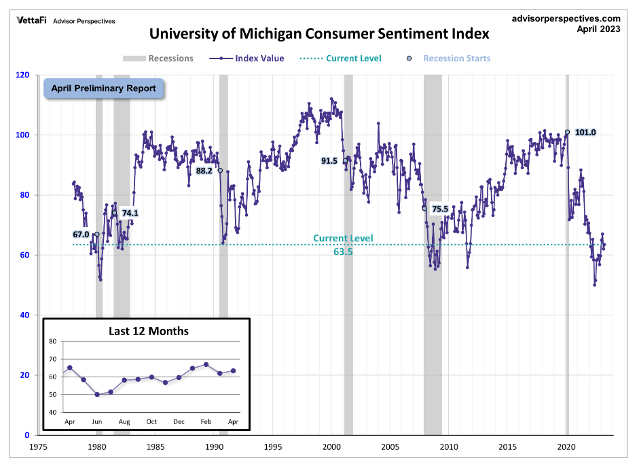

The chart evaluates the historical context for this index as a coincident indicator of the economy. Toward this end, Advisor Perspectives highlighted recessions. To put the current data into better perspective, professionals state a current consumer sentiment of 63.5 is below the index’s level at the start of all six recessions since the index’s inception. In addition, consumer sentiment is 25.5% below its average reading (arithmetic mean) and 24.6% below its geometric mean. The current index level is at the 7th percentile of the 544 monthly data points in this series. The indicator is somewhat volatile, with a 3.1-point absolute average monthly change. The latest data point saw a 1.5-point decrease from the month prior.

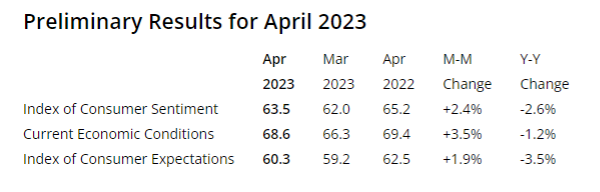

The University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – registered 62.0 in March, a significant dip from 67.0 in February. Consumer sentiment is tracking slightly up in preliminary reporting for April, at 63.5.

Important Takeaways, Courtesy of Survey of Consumers:

- Consumer sentiment is down approximately 3% compared to a year ago.

- Rising sentiment among lower-income consumers was negatively offset by those with higher incomes.

- While consumers acknowledged easing inflation among durable goods and cars, they still expect high inflation to persist – at least in the short run.

- Year-ahead inflation expectations rose from 3.6% in March to 4.6% in April.

- Unpredictable inflation expectations are limited to the short run, as long-run inflation expectations remained “remarkably stable” at 2.9% for the fifth consecutive month. The metrics are within the narrow 2.9-3.1% range for 20 of the last 21 months.

“While inflation has eased from its peak last summer and, likewise, sentiment has lifted from its all-time low, high prices continue(d) to be a primary drag on consumer attitudes,” says Joanne Hsu, director at Survey of Consumers.

Consumer Income & Spending

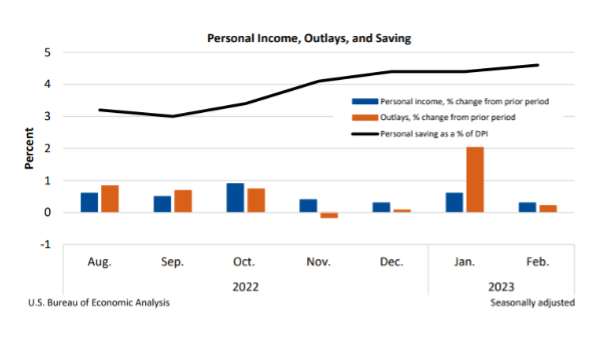

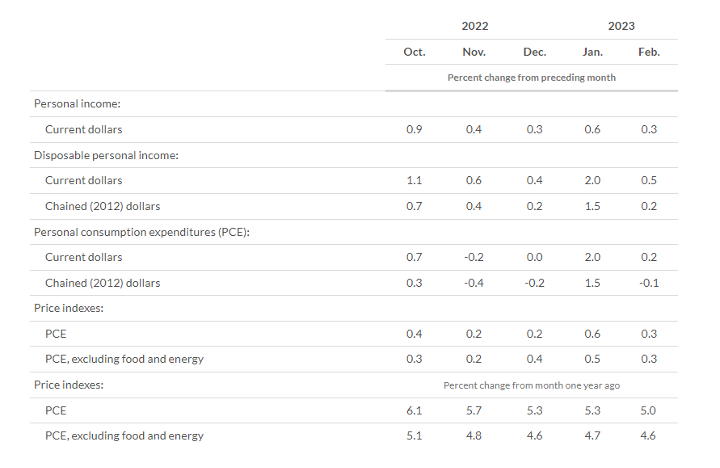

According to the U.S. Bureau of Economic Analysis (BEA), in February 2023 personal income increased $72.9 billion (0.3%), disposable personal income (DPI) increased $89.9 billion (0.5%) and personal consumption expenditures (PCE) increased $27.9 billion (0.2%).

In addition, personal outlays increased $40.7 billion in February. Personal saving was $915.8 billion, while the personal saving rate – personal saving as a percentage of disposable personal income – was 4.6%.

Important Takeaways, Courtesy of BEA:

- The $27.9 billion increase in current-dollar PCE in February reflected an increase of $25.8 billion in spending for services, plus an increase of $2 billion in spending for goods. Within services, a rise in housing and health care was partly offset by a decrease in food services and accommodations. Conversely, increases in gasoline and other energy goods, “other” nondurable goods (led by pharmaceuticals), as well as food and beverages were partly offset by a decrease in motor vehicles and parts (mainly new and used light trucks).

- The PCE price index increased 0.3% month-over-month. Real DPI increased 0.2% in February and Real PCE decreased 0.1%. Goods and services each decreased 0.1%.

- The PCE price index for February increased 5% year-over-year. Prices for goods increased 3.6%, while prices for services increased 5.7%. Food and energy prices increased 9.7% and 5.1%, respectively. Excluding food and energy, the PCE price index increased 4.6% year-over-year.

Key Performance Indicators Report — April 2023