KPI — April 2021: State of the Economy

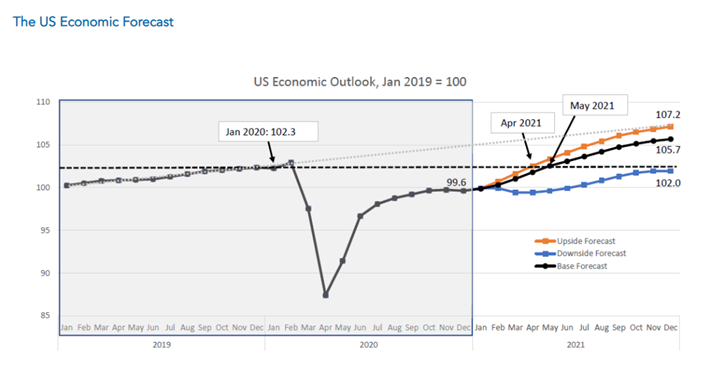

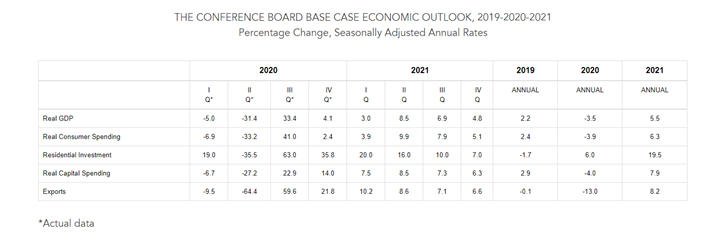

The Conference Board forecasts that U.S. real GDP growth will rise to 3% (annualized rate) in Q1 and 5.5% year-over-year in 2021.*

“Following a lull in the economic recovery in November and December, growth has improved,” reported The Conference Board. “We expect real GDP growth to accelerate further over the coming quarters as new COVID-19 infection rates steadily decline, the vaccination program expands and an additional large fiscal support program is deployed. Following a robust recovery in 2021, we forecast year-over-year economic growth of 3.5% in 2022.”

The Conference Board has generated three potential recovery scenarios based on specific sets of assumptions.

All data and analysis are courtesy of The Conference Board.

- Base Forecast: The base case forecast yields Q1 2021 real GDP growth of 3% (annualized rate), and a year-over-year annual expansion of 5.5% in 2021.* The recovery will likely continue into next year and yield a year-over-year annual growth rate of 3.5% in 2022. This scenario is viewed as the most probable and assumes: a) new cases of COVID-19 peak in early Q1 2021 and many social distancing restrictions are subsequently retracted; b) COVID-19 vaccinations rise in Q1 2021, are broadly available in Q2 2021 and are universally available in early Q3 2021; c) $1.9 trillion in additional fiscal support is deployed in Q2 2021 and Q3 2021; and d) moderate improvements in labor markets and consumption in Q1 2021 precede a sharp rebound in Q2 2021 and Q3 2021. In this scenario, U.S. monthly economic output returns to pre-pandemic levels in May 2021.

- Upside Forecast: A second, more optimistic scenario is the economy grows 6.5% year-over-year in 2021 and assumes: a) new COVID-19 cases fall dramatically in Q1 2021 and all social distancing policies are virtually eliminated in Q2 2021; b) vaccines are broadly available by the end of Q1 2021 and are universally available in Q2 2021; c) $1.9 trillion in additional fiscal support is deployed in Q2 2021 and Q3 2021 with more on the horizon; and d) large improvements in unemployment result in a rebound in consumption by the end of Q1 2021. In this scenario, U.S. monthly economic output returns to pre-pandemic levels in April 2021.

- Downside Forecast: A third, more pessimistic scenario is the economy grows by just 2.8% year-over-year in 2021 and assumes: a) new cases of COVID-19 rise as vaccine-resistant mutations result in an additional wave by Q4 2021; b) social distancing restrictions remain and are augmented to address the outbreaks; c) distribution of vaccines is prolonged and mutations render them ineffective; d) the fiscal support package is reduced in size and delayed until sometime in Q2 2021; e) unemployment deteriorates and the consumption recovery stagnates; and f) a large correction in equity markets hurts consumer and business confidence. In this scenario, U.S. monthly economic output does not recover to pre-pandemic levels until sometime in 2022.

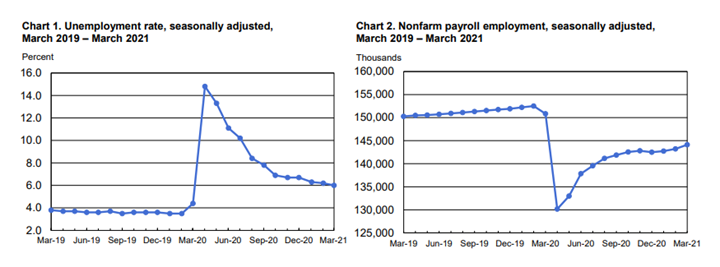

Employment

Total nonfarm payroll employment jumped 916,000 in March. The unemployment rate edged down to 6%, with 9.7 million people out of work, according to the U.S. Bureau of Labor Statistics. While unemployment is down considerably from its recent high in April 2020, it remains 2.5 percentage points higher than its pre-pandemic level in February 2020.

- Among the unemployed, the number of persons on temporary layoff declined by 203,000 in March to two million. This measure is down considerably from the recent high of 18 million in April 2020 but is 1.3 million higher than in February 2020.

- The number of permanent job losers is little changed at 3.4 million and remains 2.1 million higher than February 2020.

- The number of long-term unemployed (those jobless for 27 weeks or more) remains essentially unchanged month-over-month at 4.2 million, accounting for 43.4% of the total unemployed.

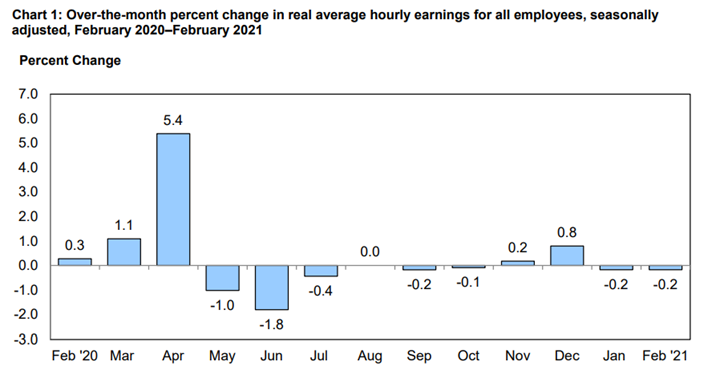

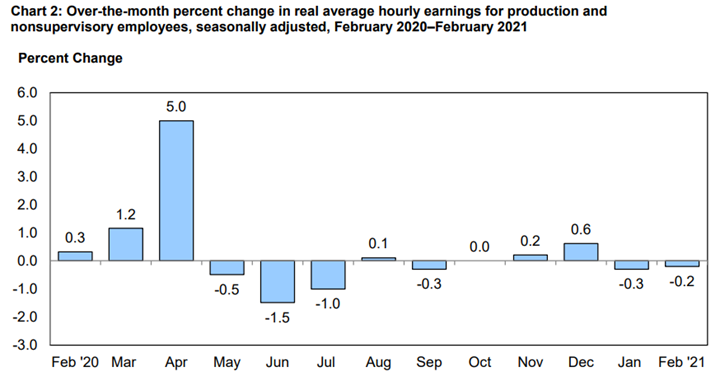

Real average hourly earnings increased 3.4% (seasonally adjusted) from February 2020 to February 2021. The change in real average hourly earnings combined with an increase of .6% in the average workweek resulted in a 4.1% increase in real average weekly earnings over this period.

From February 2020 to February 2021, real average hourly earnings increased 3.2% (seasonally adjusted). The change in real average hourly earnings combined with a .9% increase in the average workweek resulted in a 4% increase in real average weekly earnings over this period.

By Demographic

Unemployment rates among all major worker groups in March: adult men—5.8%, adult women—5.7%, teenagers—13%, Whites—5.4%, Asians—6%, Hispanics—7.9% and Blacks—9.6%.

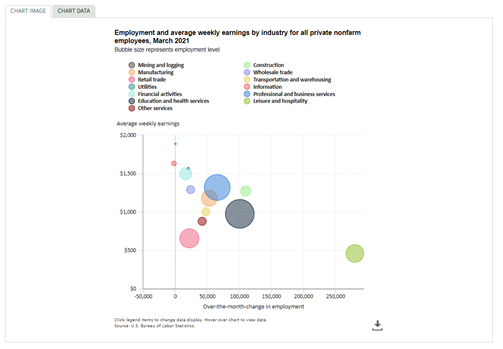

By Industry

Job growth in March was widespread, with the largest gains occurring in leisure and hospitality, public and private education, as well as construction.

Important employment takeaways, courtesy of the U.S. Bureau of Labor Statistics:

• Employment in leisure and hospitality increased by 280,000, as pandemic-related restrictions eased in many parts of the country. Approximately two-thirds of the increase was in food services and drinking places (+176,000). Job gains also occurred in arts, entertainment and recreation (+64,000) and in accommodation (+40,000). Employment in leisure and hospitality is down by 3.1 million, or 18.5%, since February 2020.

• Employment in professional and business services rose by 66,000 but is down by 685,000 since February 2020. Administrative and support services continued to trend up (+37,000), although employment in its temporary help services component was essentially unchanged. Employment also continued on an upward trend in management and technical consulting services (+8,000) and in computer systems design and related services (+6,000).

• Manufacturing employment rose by 53,000, with job gains occurring in both durable goods (+30,000) and nondurable goods (+23,000). Employment in manufacturing is down by 515,000 since February 2020.

• Transportation and warehousing added 48,000 jobs. Employment increased in couriers and messengers (+17,000), transit and ground passenger transportation (+13,000), support activities for transportation (+6,000) and air transportation (+6,000). Since February 2020, employment in couriers and messengers is up by 206,000 (or 23.3%), while employment is down by 112,000 (or 22.8%) in transit and ground passenger transportation and by 104,000 (or 20.1%) in air transportation.

• Construction added 110,000 jobs, following job losses a month prior (-56,000). Employment growth in the industry was widespread in March, with gains of 65,000 in specialty trade contractors, 27,000 in heavy and civil engineering construction and 18,000 in construction of buildings. Employment in construction is 182,000 below its February 2020 level.

Click here for more detailed employment information by industry.

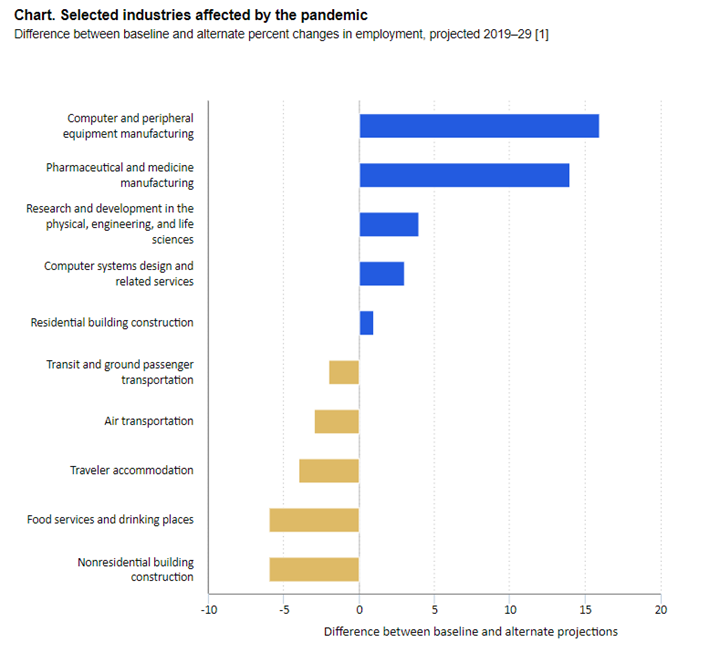

The U.S. Bureau of Labor Statistics developed alternate projections scenarios to analyze how pandemic-related circumstances are expected to affect long-term employment. These alternate projections assume that the pandemic creates structural changes to the future job market in some industries. As data in the chart suggest, for example, the continued need for medical treatments and vaccines may spur demand for workers in pharmaceutical and medicine manufacturing, while a greater prevalence of telework may negatively impact employment in office building construction. The data in the chart is based on the moderate-impact scenario. The alternate sets of projections are not intended as precise estimates of employment change over the 2019–2029 decade; instead, they identify industries in which employment is subject to the most pandemic-related uncertainty.

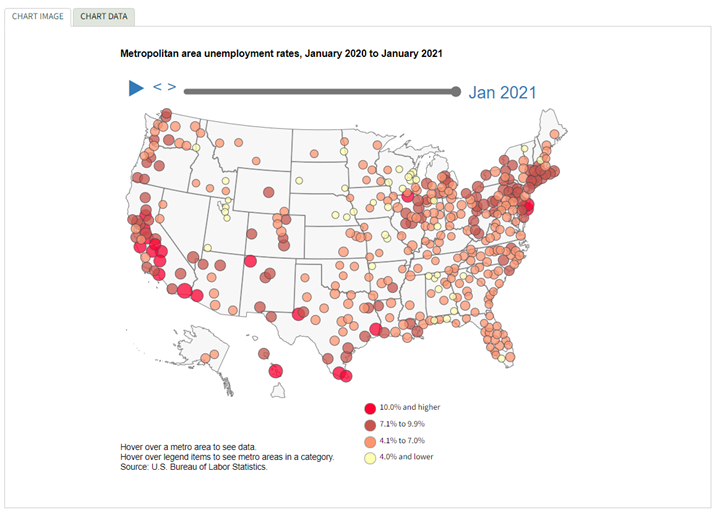

By Geography

During February, unemployment rates were lower in 23 states and the District of Columbia, higher in four states and stable in 23 states. Forty-five states and the District had jobless rate increases from a year earlier and five states showed little or no change.

Hawaii and New York posted the highest unemployment rates at 9.2% and 8.9%, respectively, while South Dakota—2.9% and Utah—3% recorded the lowest.

In total, 27 states had unemployment rates lower than the U.S. figure of 6.2%, 12 states and the District of Columbia had higher rates and 11 states had rates that were not appreciably different from that of the nation.

The largest job gains were in California (+141,000), Michigan (+63,500) and Washington (+28,700). The largest percentage increase occurred in Michigan (+1.6%), followed by California, New Mexico and Washington (+.9% each). Employment decreased in Missouri (-11,600, or -.4%), Oklahoma (-10,700, or -.7%) and Mississippi (-7,000, or -.6%).

KPI — April 2021: Consumer Trends

Key Performance Indicators Report — April 2021