- KPI – May 2025: The Brief

- KPI – May 2025: State of Business – Automotive Industry

- KPI – May 2025: State of the Economy

- KPI – May 2025: Consumer Trends

- KPI – May 2025: Recent Vehicle Recalls

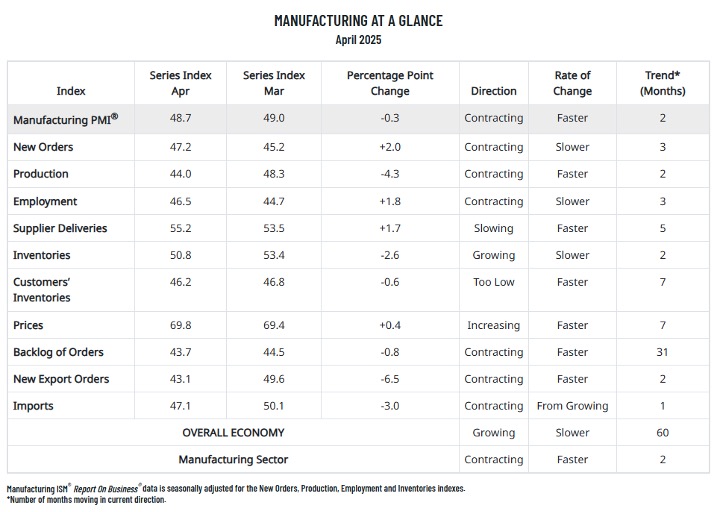

Economic activity in the manufacturing sector contracted in April for the second month in a row, following a two-month expansion preceded by 26 straight months of contraction, say the nation’s supply executives in the latest Manufacturing ISM Report On Business. The Manufacturing PMI registered 48.7% in April, 0.3 percentage point lower compared to the 49% recorded in March.

“In April, U.S. manufacturing activity slipped marginally further into contraction after expanding only marginally in February. Demand and output weakened while input strengthened further, conditions that are not considered positive for economic growth,” says Timothy R. Fiore, CPSM, C.P.M., chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee.

Data shows 41% of manufacturing gross domestic product (GDP) contracted in April, down from 46% in March. The share of manufacturing sector GDP registering a composite PMI calculation at or below 45% (a good barometer of overall manufacturing weakness) was 18% in April, an 11-percentage point increase compared to the 7% reported in March.

Important takeaways, courtesy of the Manufacturing ISM Report On Business:

- Indications that demand weakened include: (1) the New Orders Index continuing in contraction territory, (2) New Export Orders Index dropping sharply further into contraction, (3) Backlog of Orders Index contracting at a faster rate, and (4) Customers’ Inventories Index remaining in “too low” territory.

- Output (measured by the Production and Employment indexes) also weakened. Factory output (production) contracted further in April, indicating that panelists’ companies are continuing to revise production plans downward in the face of economic headwinds.

- The Employment Index ticked up but remained in contraction, as panelists’ companies continued to release workers. Companies generally opted for layoffs because they are quicker to implement than attrition.

- Inputs are defined as supplier deliveries, inventories, prices and imports. Except for imports, the other indexes indicated expansion. Inventory growth is not a positive sign when demand is moving in the opposite direction. The recent expansion is considered a temporary move to avoid tariffs, and levels will decline when such trade issues are resolved.

- Supplier delivery performance reflects this pull-forward activity and delays in clearing goods through ports of entry.

What respondents are saying, according to the Manufacturing ISM Report On Business:

“Uncertainty over tariffs is providing a big challenge from both Tier-1 suppliers we will have to pay tariffs on directly, and Tier-2 suppliers that will try to pass tariffs through to us in the form of price increases and tariff surcharges.” [Chemical Products]

“Tariffs impacting operations—specifically, delayed border crossings and duties calculations that are complex and not completely understood. As a result, we are potentially overpaying duties. Unsure of potential drawbacks. Implementation of tariffs and their application is sudden and abrupt. The business is taking countermeasures.” [Transportation Equipment]

“Business climate is apprehensive, and with tariff costs implemented, all inbound Chinese shipments are on hold. It is not feasible for our business or customers to sustain the pricing required to provide an acceptable margin.” [Computer & Electronic Products]

“The most important topic is tariffs. Risks include margin erosion due to rising operational costs and freight delays disrupting delivery timelines. Supplier relationships are strained by pain-share negotiations, and competitors are gaining share by importing from lower-tariff regions.” [Food, Beverage & Tobacco Products]

“Tariff whiplash is causing us major issues with customers. The two issues we are seeing: (1) customers are holding back orders to understand what is happening with tariffs on their products or (2) they are forcing us to accept the tariffs, which causes us to “no quote” the job as we cannot take on that type of risk for an order.” [Machinery]

“There is a lot of concern about the inflationary impacts from tariffs in our industry. Domestic producers are charging more for everything because they can.” [Fabricated Metal Products]

“Tariff trade wars are incredibly volatile, quickly changing and disrupting a ton of our current work. We are 90% sourced out of China, and the cost models keep changing every week. We are flying to visit suppliers in a few weeks to negotiate current terms and pricing, as well as develop more long-term, strategic plans to reduce risk in the region.” [Apparel, Leather & Allied Products]

“Demand is slightly lower than plan, but it has been steady amid tariff concerns. Significant time has been spent quantifying the impact of changing tariff rates. Our costs will increase, and we are discussing how to share that impact across suppliers and customers.” [Electrical Equipment, Appliances & Components]

“The recently imposed 145% tariff rate on Chinese imports is significantly affecting our 2025 profitability. Due to the complexity of our parts and the lack of alternate sources, we are unable to find any alternate suppliers—especially at a reasonable cost—to our current Chinese sources. Incoming orders have slowed due to market volatility and uncertainty.” [Miscellaneous Manufacturing]

“Strategic procurement and the supply chain are paralyzed in a world that changes daily due to tariffs.” [Nonmetallic Mineral Products]