- KPI – March 2025: The Brief

- KPI – March 2025: State of Manufacturing

- KPI – March 2025: State of Business – Automotive Industry

- KPI – March 2025: State of the Economy

- KPI – March 2025: Recent Vehicle Recalls

Below is a synopsis of consumer confidence, sentiment, demand and income/spending trends.

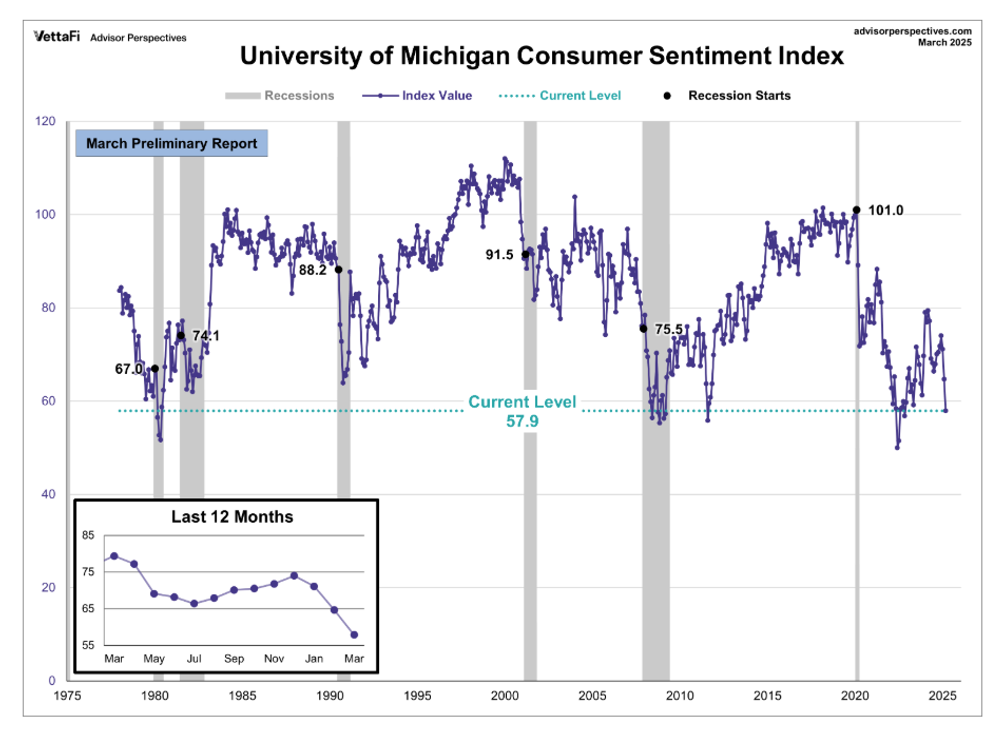

The University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – registered 64.7% in February and posted a preliminary reading of 57.9% in March.

Consumer sentiment dropped 11% this month and 22% since December 2024, with declines observed across all groups by age, education, income, wealth, political affiliations and geographic regions. Despite an increase in confidence post-election, Republicans and Independents posted a sizable 10% and 12% decline, respectively, in the expectations index during March.

“While current economic conditions were little changed, expectations for the future deteriorated across multiple facets of the economy, including personal finances, labor markets, inflation, business conditions and stock markets. Many consumers cited the high level of uncertainty around policy and other economic factors,” says Joanne Hsu, survey director. “Frequent gyrations in economic policies make it very difficult for consumers to plan for the future, regardless of one’s policy preferences.”

Year-ahead inflation expectations jumped from 4.3% last month to 4.9% this month, the highest reading since November 2022 and the third consecutive month of unusually large increases of 0.5 percentage points or more. Long-run inflation expectations surged from 3.5% in February to 3.9% in March.

“This is the largest month-over-month increase seen since 1993, stemming from a sizable rise among Independents, and followed an already-large increase in February,” Hsu says.

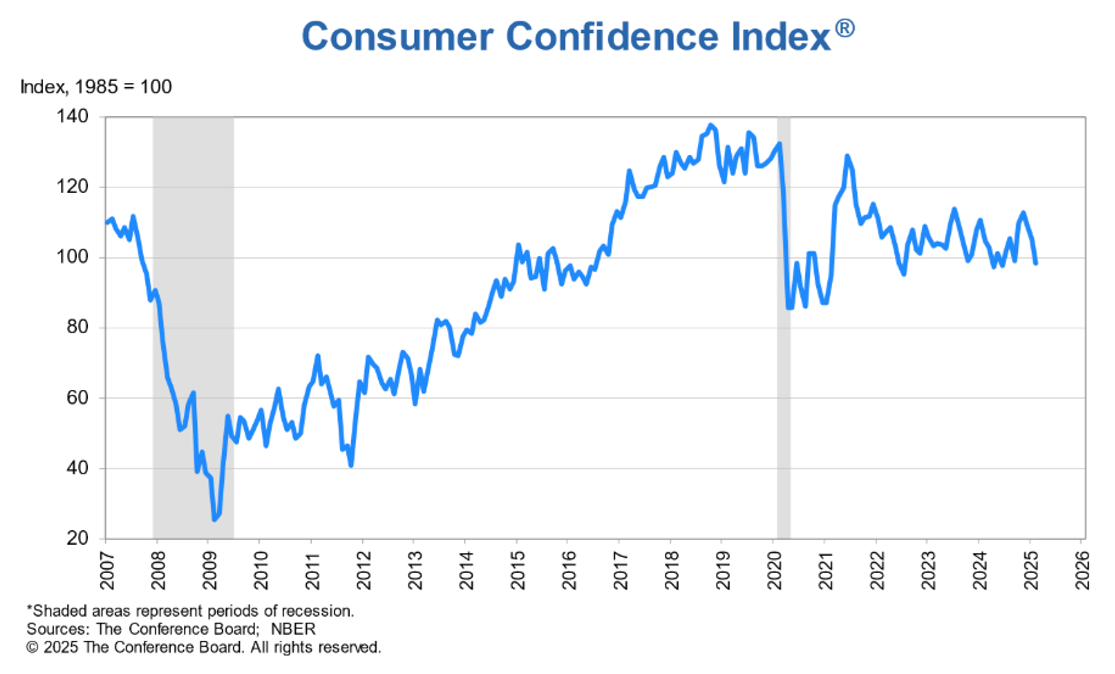

Similarly, the Conference Board Consumer Confidence Index dropped to 98.3 in February. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – fell 3.4 points to 136.5. Meanwhile, the Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – declined 9.3 points to 72.9. For the first time since June 2024, the Expectations Index registered below the threshold of 80, a figure that historically signals a recession ahead.

“In February, consumer confidence registered the largest monthly decline since August 2021,” says Stephanie Guichard, senior economist of global indicators at The Conference Board. “Of the five components of the Index, only consumers’ assessment of present business conditions improved, albeit slightly. Views of current labor market conditions weakened. Consumers became pessimistic about future business conditions and less optimistic about future income. Pessimism about future employment prospects worsened and reached a 10-month high.”

Data shows average 12-month inflation expectations surged from 5.2% to 6% in February. According to Guichard, the increase likely reflected a mix of factors, from sticky inflation and consistent price hikes for household staples to the upcoming impact of tariffs. The proportion of consumers anticipating a recession over the next 12 months increased to a nine-month high.

“References to inflation and prices in general continue to rank high in write-in responses, but the focus shifted towards other topics. There was a sharp increase in the mentions of trade and tariffs, back to a level unseen since 2019,” Guichard says.

In addition, consumers’ views of their Family’s Current and Future Financial Situation, the stock market and vacation plans were less positive. While the fall in confidence was shared across all age groups and most income groups, it was sharpest for consumers between 35 and 55 years old and households earning less than $15,000 a year or between $100,000–125,000.

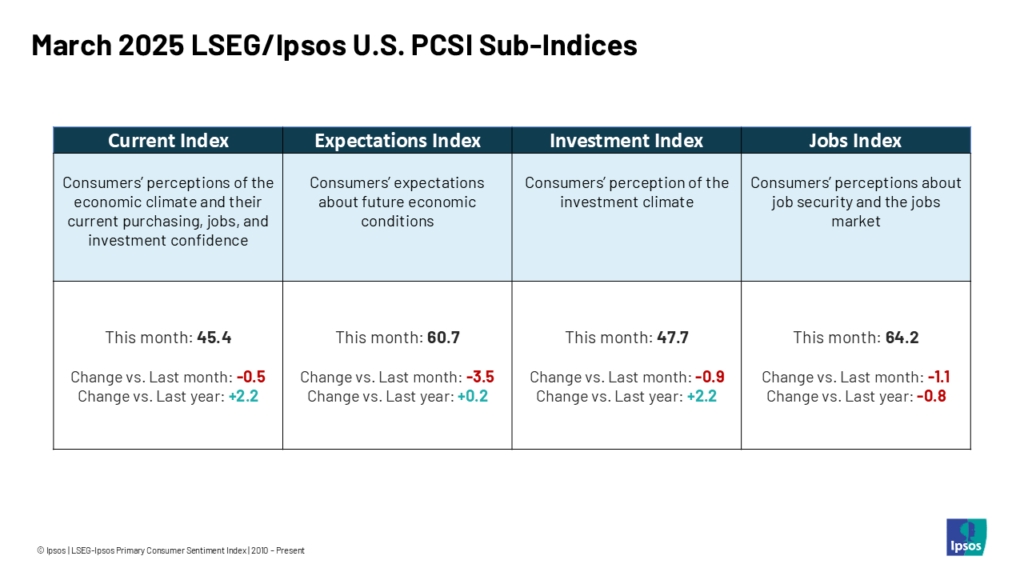

Note: While the March 2025 LSEG/Ipsos Primary Consumer Sentiment Index and The Employment Trends Index (ETI) posted declines month-over-month, they were not as sharp and alarming as the University of Michigan Survey of Consumers and The Conference Board sentiment and confidence data. Furthermore, the Fiserv Small Business Index and NFIB Small Business Index were largely optimistic but reflective of America’s current state of reality – uncertainty. Readers are encouraged to review all available data sources to ensure comprehensive and impartial representation.

Consumer Income & Spending

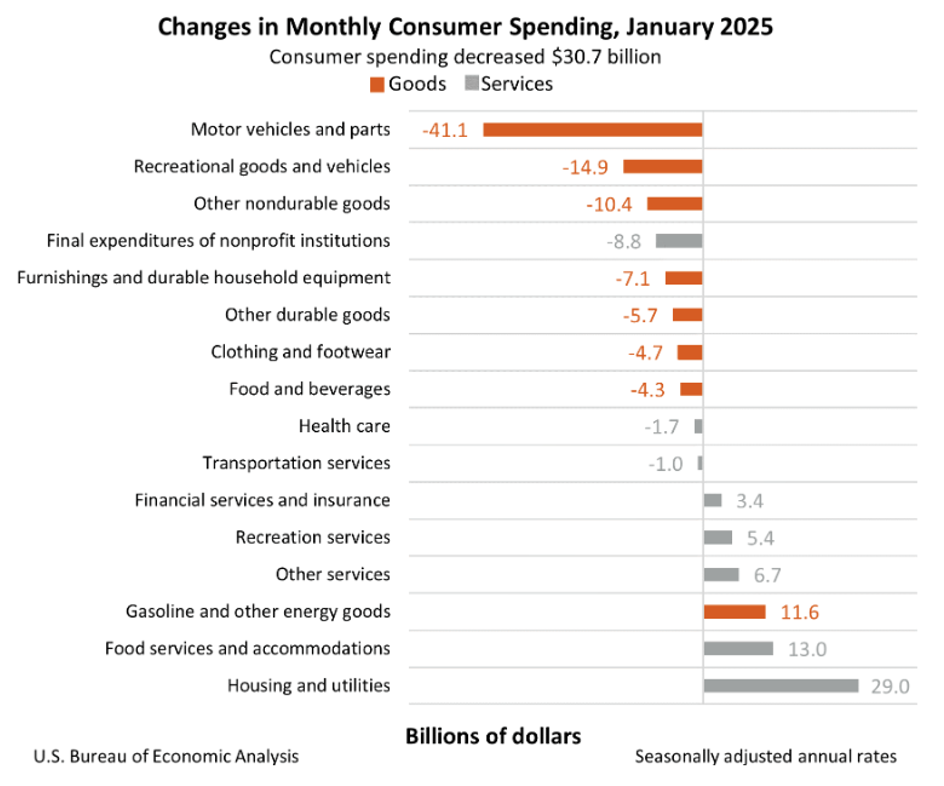

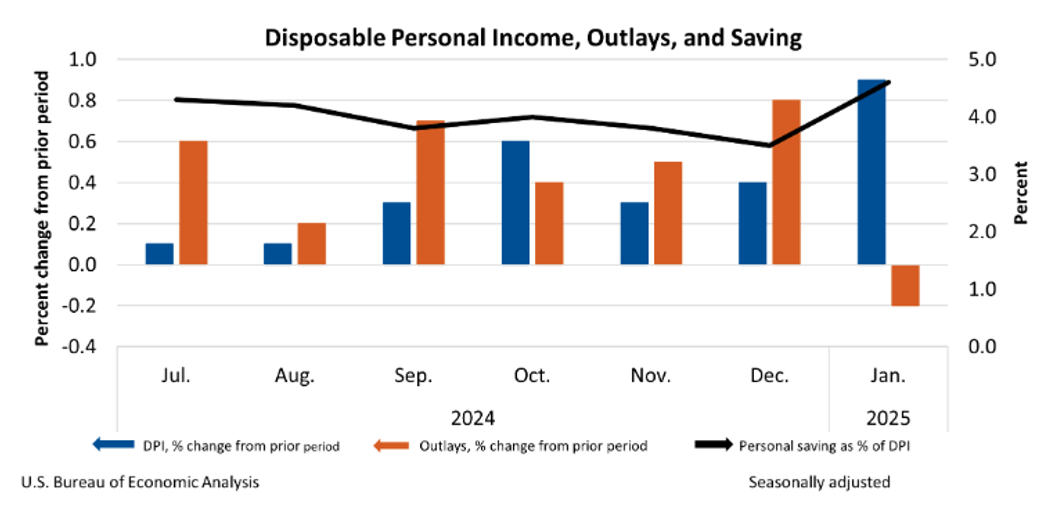

According to the U.S. Bureau of Economic Analysis (BEA), in January 2025 personal income increased $221.9 billion (0.9% at a monthly rate). Disposable personal income (DPI) – personal income less personal current taxes – increased $194.3 billion (0.9%), while personal consumption expenditures (PCE) decreased $30.7 billion (0.2%).

Personal outlays – the sum of personal consumption expenditures, personal interest payments and personal current transfer payments – decreased $52.7 billion. Personal saving was $1.01 trillion in January and the personal saving rate – personal saving as a percentage of disposable personal income – registered 4.6%.

Important Takeaways, Courtesy of BEA:

- In January, the $30.7 billion decrease in current-dollar PCE reflected a decrease of $76.7 billion in spending for goods and an increase of $46 billion in spending for services.

- The PCE price index increased 2.5% year-over-year. Excluding food and energy, the PCE price index increased 2.6% from one year ago.