- KPI – February 2025: Consumer Trends

- KPI – February 2025: State of Manufacturing

- KPI – February 2025: State of Business – Automotive Industry

- KPI – February 2025: State of the Economy

- KPI – February 2025: Recent Vehicle Recalls

The Conference Board Consumer Confidence Index declined from an upwardly revised 109.5 in December 2024 to 104.1 in January 2025.

To put the index in broader context, consumer confidence was 105.6 in August 2024, 99.2 in September 2024, 108.7 in October 2024 and 111.7 in November 2024. While the index dipped month over month, current data falls within the median range reported over the last six months.

The University of Michigan Survey of Consumers also posted a month-over-month decline, sliding from 71.1 in January to 67.8 in preliminary February data. Survey of Consumers director Joanne Hsu says decreases in various survey indexes, including a 12% drop in buying conditions for durables, reflect “a perception that it may be too late to avoid the negative impact of tariff policy.”

While consumers across the country are feeling the heat with rising rent, utilities and insurance, alongside elevated grocery costs and fluctuating mortgage rates, some key data points shine brightly.

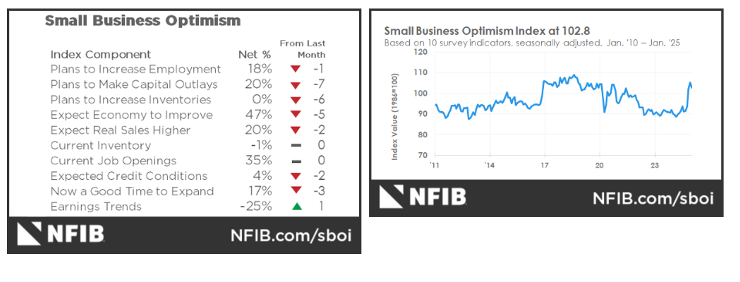

The seasonally adjusted Fiserv Small Business Index registered 147 in January 2025, up a point month over month on the heels of previous gains. Increased spending in Professional Services, Educational Services, Repair and Maintenance and Building Materials drove small business growth. Moreover, January 2025 sales growth (+5.1%) across the U.S. outpaced the 2024 full-year growth rate of +4.1%. Transactions also accelerated to +6.5%, while average tickets declined 1.4%.

At 102.8, the NFIB Small Business Optimism Index supports the trend in elevated small business confidence. While the index dipped 2.3 points in January, it is the third consecutive month above the 51-year average of 98, following 34 consecutive months below the five-decade average. To put the index in perspective, small business confidence was 91.2 in August 2024, 91.5 in September 2024, 93.7 in October 2024, 101.7 in November 2024 and 105.1 in December 2024.

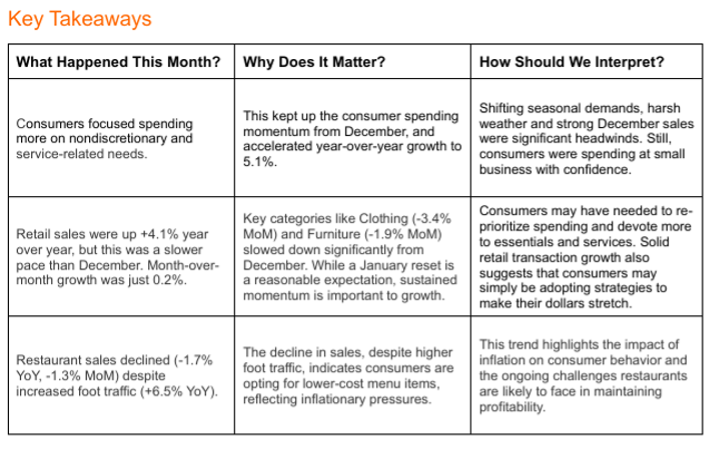

Important takeaways, courtesy of NFIB:

- 19% of owners reported that inflation was their single most important problem in operating their business, down two points from December and currently matching labor quality as the top issue.

- The net percent of owners raising average selling prices fell two points from December to a net 22% (seasonally adjusted).

- 35% (seasonally adjusted) of all owners reported job openings they could not fill in the current period, unchanged from December. Of the 52% of owners hiring or trying to hire in January, 90% reported few or no qualified applicants for the positions they were trying to fill.

“Overall, small business owners remain optimistic regarding future business conditions, but uncertainty is on the rise,” says Bill Dunkelberg, NFIB chief economist. “Hiring challenges continue to frustrate Main Street owners as they struggle to find qualified workers to fill their many open positions. Meanwhile, fewer plan capital investments as they prepare for the months ahead.”

Image Source: NFIB Small Business Optimism Index

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends. Below are a few key data points explained in further detail throughout the report.

Key Data Points:

- Economic activity in the manufacturing sector expanded in January following 26 consecutive months of contraction, say the nation’s supply executives in the latest Manufacturing ISM Report On Business.

- In January, the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5% on a seasonally adjusted basis after rising 0.4% a month prior, according to the U.S. Bureau of Labor Statistics

Over the last 12 months, the all-items index increased 3% before seasonal adjustment.

- Total new-vehicle sales for January 2025, including retail and non-retail transactions, are projected to reach 1,105,900 – a 4.4% year-over-year increase, according to a joint forecast from J.D. Power and GlobalData.

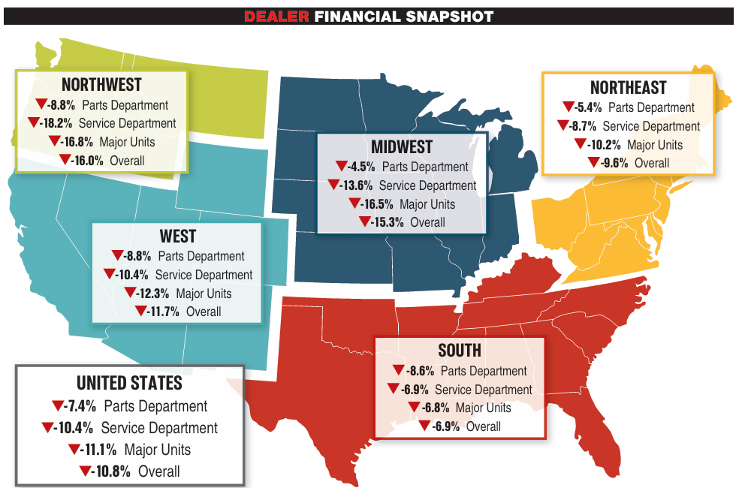

- Powersports Business says dealers across the country reported an overall combined revenue decline of 10.8% year over year in December, according to composite data from more than 1,700 dealerships in the U.S. that utilize CDK Lightspeed DMS. On average, dealerships were down 11.1% in major units, 10.4% in service and 7.4% in parts.

Image Source: Powersports Business