KPI – December 2024: The Brief

KPI – December 2024: Recent Vehicle Recalls

KPI – December 2024: State of Business – Automotive Industry

KPI – December 2024: State of Manufacturing

KPI – December 2024: Consumer Trends

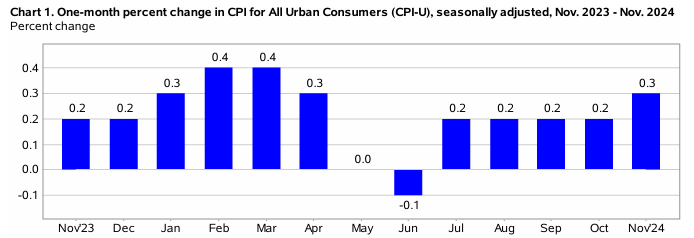

In November, the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2% on a seasonally adjusted basis, similar to the previous three months. Over the last 12 months, the all-items index increased 2.6% before seasonal adjustment.

Important takeaways, courtesy of the U.S. Bureau of Labor Statistics:

- The index for shelter rose 0.3% in November, accounting for nearly 40% of the monthly all-items increase. In addition, the food index increased 0.4% month-over-month – with the food-at-home index up 0.5% and the food-away-from-home index up 0.3%. The energy index rose 0.2%, after being unchanged in October.

- Indexes on the rise in November included shelter, used cars and trucks, household furnishings and operations, medical care, new vehicles and recreation. The index for communication was among the few major indexes which decreased month-over-month.

The all-items index rose 2.7% year-over-year, after rising 2.6% in October. The all-items-less-food-and energy index rose 3.3% during the same time period. The energy index decreased 3.2%, while the food index increased 2.4% over the last year.

Caption: While economic experts say inflation is “cooling,” consumers are still wrestling stubbornly high prices at the grocery store and gas pump. Click here for recent data detailing increases since November 2020.

As reported by Jill Dutton at The Packer, new findings from pricing lifecycle management company Zilliant indicate consumers are “increasingly resistant to price increases – even when driven by market forces such as rising costs or supply constraints.”

According to Zilliant, its inaugural Consumer Price Index Survey was designed “to understand emerging pricing trends and consumer sentiment in today’s dynamic market.” The research was conducted by Censuswide between Oct. 16-18, 2024, among 2,003 U.S. consumers aged 18 or older.

Interestingly, only 33% of consumers stated they believe prices should increase when production costs rise, while 32% explicitly stated prices should stay the same despite higher costs. This resistance to cost-based price increases underscores the growing strain between market realities and consumer expectations, according to the company’s press release.

“Pricing has never been more important to both businesses and consumers,” says Pascal Yammine, CEO at Zilliant. “While consumers are feeling the impact of rising costs, there’s a clear disconnect between how pricing actually works and how consumers think it should work. This gap presents both a challenge and an opportunity for retailers to better educate and communicate with their customers.”

Click here to read the full article.

EMPLOYMENT

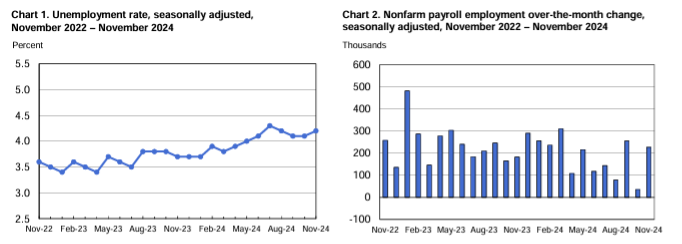

Total nonfarm payroll employment increased by 227,000 in November – slightly above Dow Jones’ estimates of 214,000. The unemployment rate and number of unemployed persons edged up to 4.2% and 7.1 million, respectively.

According to the U.S. Bureau of Labor Statistics, the labor force participation and long-term unemployed (those jobless for 27 weeks or more) rates were relatively unchanged at 62.5% and 23.2%, respectively. In addition, categories like discouraged workers and those holding part-time jobs for economic reasons were relatively unchanged month-over-month but remain high – the latter of which is up from 4 million to 4.5 million persons year-over-year.

Average hourly earnings for all employees on private nonfarm payrolls rose by 13 cents (0.4%) to $35.61. Over the past 12 months, average hourly earnings increased by 4%.

“The economy continues to produce a healthy amount of job and income gains, but a further increase in the unemployment rate tempers some of the shine in the labor market and gives the Fed what it needs to cut rates in December,” says Ellen Zentner, chief economic strategist for Morgan Stanley Wealth Management.

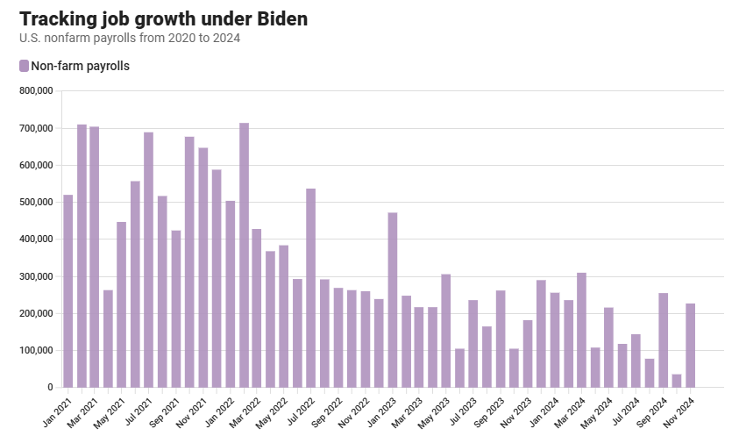

Caption: Regular monthly job revisions continue to be a troubling trend that industry professionals are monitoring closely.

The Bureau revised its data by 57,000 in April, lowering its previous estimate of 165,000 jobs added to 108,000. Likewise, May payroll estimates were revised down 54,000 jobs – decreasing total job gains from 272,000 to 218,000. That is a combined 111,000 fewer jobs in April and May than first reported, which brings the three-month average of job gains to roughly 177,000 – well below the 269,000 recorded during the first three months of the year.

Job creation in June was slashed by 61,000 (from a gain of 179,000 to 118,000), while July erased 25,000 (from a gain of 114,000 to 89,000). With the revision, July’s job creation was the lowest nonfarm payrolls reading since December 2020.

More recently, August and September fell victim to downward revisions. The former was revised down by 81,000 from a gain of 159,000 to 78,000, while the latter was revised down by 31,000 from a gain of 254,000 to 223,000. Total nonfarm payroll employment registered 12,000 in October – the lowest tally since December 2020 – then was swiftly upwardly revised by 36,000.

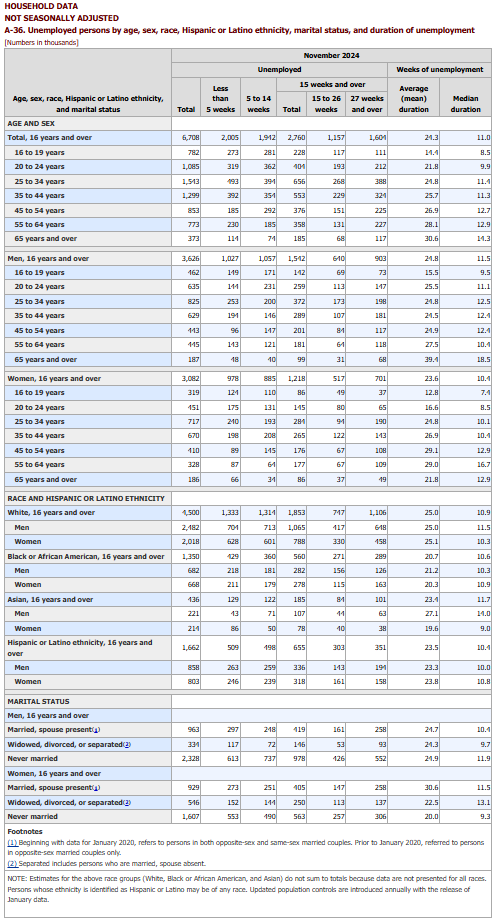

By Demographic

This month, unemployment rates among the major worker groups: adult women – 3.9%; adult men – 3.9%; teenagers – 13.2%; Asians – 3.8%; Whites – 3.8%; Hispanics – 5.3%; and Blacks – 6.4%.

Last month, unemployment rates among the major worker groups: adult women – 3.6%; adult men – 3.9%; teenagers – 13.8%; Asians – 3.9%; Whites – 3.8%; Hispanics – 5.1%; and Blacks – 5.7%.

Source: U.S. Bureau of Labor Statistics data

Image Source: A-36. Unemployed persons by age, sex, race, Hispanic or Latino ethnicity, marital status, and duration of unemployment (bls.gov)

By Industry

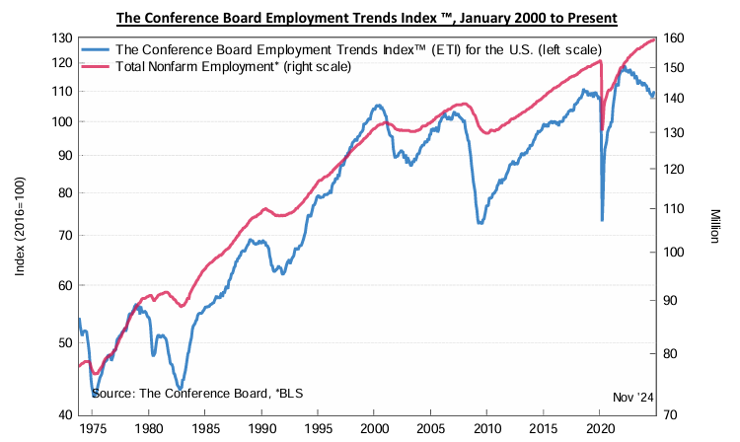

The Conference Board Employment Trends Index (ETI) ticked up from an upwardly revised 108.25 in October to 109.55 in November.

“The increases in October and November add up to the largest two-month increase in the ETI since the torrid period of job gains in 2022 coming out of the pandemic,” says Mitchell Barnes, economist at The Conference Board.

According to Barnes, rising sentiment among both jobseekers and businesses is contributing to the ETI increases. Data shows the share of consumers who report “jobs are hard to get” – an ETI component from the Consumer Confidence Survey – fell for the second consecutive month to 15.2% in November, down from 17.6% in October.

The share of firms reporting “jobs not able to fill right now” (an ETI component) also is on the rise the past two months, while job openings have rebounded from September when opening hit a post-pandemic low.

“The improvement in ETI largely reflects November data on employment, turnover and economic activity – which all came in on target,” Barnes says. “We see labor demand sitting in a healthy range through November, but a range that is clearly lower than we saw in the rehiring frenzy following the pandemic. Looking ahead, we see more positive sentiment, perhaps benefiting from reduced policy and interest rate uncertainty, that could help maintain and bolster labor market strength into 2025.”

Caption: The Employment Trends Index is a leading composite index for payroll employment. When the index increases, employment is likely to grow as well, and vice versa. Turning points in the index indicate that a change in the trend of job gains or losses is about to occur in the coming months.

Important takeaways, courtesy of the U.S. Bureau of Labor Statistics:

- Healthcare added 54,000 jobs in November, in line with the average monthly gain of 59,000 over the prior 12 months. Ambulatory healthcare services added 22,000 jobs, led by a gain of 16,000 in home healthcare services. Employment also increased in hospitals (+19,000) and nursing and residential care facilities (+12,000).

- Leisure and hospitality trended up in November (+53,000), following little change last month (+2,000). Over the month, employment is up in food services and drinking places (+29,000). Leisure and hospitality added an average of 21,000 jobs per month over the prior 12 months.

- Government employment continued to trend up (+33,000), in line with the average monthly gain over the prior 12 months (+41,000). State government increased (+20,000).

Click here to review more employment details.