KPI – May 2024: Recent Vehicle Recalls

KPI – May 2024: State of Manufacturing

KPI – May 2024: State of the Economy

KPI – May 2024: Consumer Trends

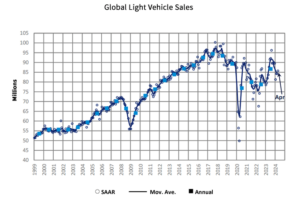

Global Light Vehicle Sales

In April, the Global Light Vehicle (LV) selling rate registered 86 million units per year – a modest improvement over last month and a 2.8% year-on-year increase. Year-to-date sales are up 3.8 %, with global light vehicle figures closing out the first quarter at 20.7 million units – up 4% versus Q1 2023.

“The outlook for 2024 is essentially unchanged at 89.2 million units, a 3% year-over-year increase. This year is a balancing act between supply and demand. As production constraints fully dissipate, natural demand will be able to be met at current prices. Given that we do expect some easing of pricing throughout most major markets, the global auto industry is expected to maintain a positive outlook in the near term,” says Jeff Schuster, vice president of research and automotive at GlobalData.

Caption: Market Lines is now excluding exports from the China sales total. The adjustment has been backdated to 2018.

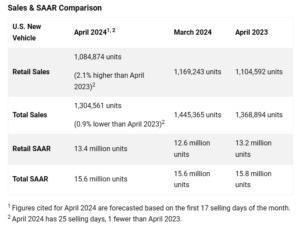

U.S. New Vehicle Sales

Total new-vehicle sales for April 2024, including retail and non-retail transactions, are projected to reach 1,304,600 units – a 0.9% year-over-year decrease on a selling day adjusted basis, according to a joint forecast from J.D. Power and GlobalData.

“April is showing mixed results, with an increase in retail sales offset by a decline in sales to fleet buyers,” says Thomas King, president of the data and analytics division at J.D. Power. “This is a notable change from recent months in which manufacturers have increased fleet sales. Although sales to retail buyers are rising, the rate of growth is modest. This is due in part to discounts from manufacturers and retailers stabilizing, coupled with ongoing deterioration of used-vehicle values that results in shoppers having less trade-in equity.”

“While the stabilization of discounting is positive for short-term industry profitability, the modest growth rate means that inventory at dealerships is continuing to rise and discounting is expected to increase. This should elevate the sales pace at the expense of per unit profitability,” he continues.

Important Takeaways, Courtesy of J.D. Power:

- Retail buyers are on pace to spend $46.4 billion on new vehicles, down $1.7 billion year-over-year.

- Trucks/SUVs are estimated to account for 79.2% of new vehicle retail sales in April.

- The average new-vehicle retail transaction price is expected to reach $45,093, down $1,172 year-over-year.

- Average incentive spending per unit is predicted to reach $2,633, up from $1,680 last year.

- Average interest rates for new-vehicle loans are on pace to increase to 7%, 20 basis points higher than a year ago.

- Total retailer profit per unit, which includes vehicle gross plus finance and insurance income, is expected to be $2,588 – down 29.8% year-over-year.

- Fleet sales are expected to total 219,687 units, down 13.6% year-over-year on a selling day adjusted basis. Fleet volume is expected to account for 16.8% of total light-vehicle sales, down 2.5 percentage points from a year ago.

“May is traditionally one of the larger sales months of the year, facilitated by Memorial Day promotional activity and discounts from manufacturers. In recent years, with low inventories and high demand, holiday sales incentives were scarce,” King says. “However, with inventories increasing and competition intensifying, shoppers could benefit from brands eager to move inventory.”

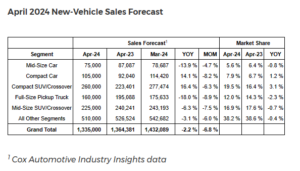

Review a comprehensive 2024 forecast, courtesy of Cox Automotive.

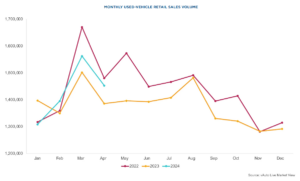

U.S. Used Market

Wholesale used-vehicle prices (on a mix-, mileage- and seasonally-adjusted basis) increased 0.3% from April during the first 15 days of May. The mid-month Manheim Used Vehicle Value Index rose to 199.1, down 11.3% from the full month of May 2023.

“Although we saw stronger declines in April against what is normal, declines in vehicle values have decelerated in early May,” says Jeremy Robb, senior director of economic and insights at Cox Automotive. “Over the last two weeks, we’ve seen slightly higher sales conversion at Manheim, which has helped to slow the declines in wholesale value trends at the start of the month.”

Caption: According to vAuto Live Market View data estimates, retail used-vehicle sales were down by 7% month-over-month. A total of 1.45 million used vehicles were sold at retail – from both franchised and independent dealers – during April, up 4.8% year-over-year. “As tax refund season winds down, it’s normal to see consumer demand for used vehicles back off in April, and that’s what we experienced this year as well,” says Robb. “With interest rates remaining elevated, consumers need a bit more of a push to buy at this time of year. While prices were lower against 2023, it was enough to attract more buyers from the sidelines at this point. Used retail sales were higher against last year’s levels, but tight inventory and affordability issues continue to be a challenge for the industry.”

According to Manheim, all major market segments saw seasonally-adjusted prices that remained lower year-over- year during the first half of May. The industry’s decline registered 11.3%, with the pickup and luxury segments outperforming the index overall at 10.6% and 10.8%, respectively.

In addition, SUVs, mid-size cars and compact cars were down 12.4%, 15.7% and 16.3% year-over-year, respectively. Overall, electric vehicles (EVs) were down 15.2% against year-over-year values, while the non-EV segment dropped 10.8%.