KPI — June 2022: State of Business — Automotive Industry

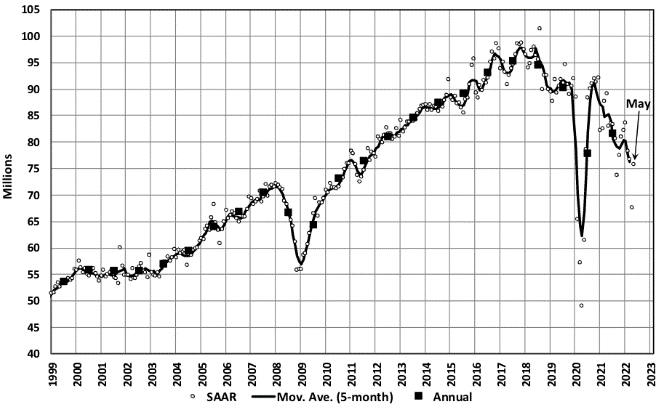

LMC Automotive reports Global Light Vehicle (LV) sales improved to 76 million units per year in May but remains down 10% year-over-year. Supply chain bottlenecks remain the key issue for the global automotive industry, with manufacturers unable to meet demand in most regions. The U.S. market, in particular, continues to struggle in the face of record-high transaction prices, low inventory and dismal manufacturer incentives.

Early indicators in May suggest declines are expected to continue, according to Jeff Schuster, president of the Americas operations and global vehicle forecasts at LMC Automotive. The company forecasts global sales to be off 15% in May, though down-side risk remains high in the near term. While the selling rate is expected to improve to 72 million units, Schuster says it is more than 10 million units below the rate in May 2021.

As such, the outlook for sales remains severely constrained, triggering another round of cuts to the 2022 forecast. LMC expects 2022 to finish the year at 80 million units, a 2% year-over-year decline. Most of the cut is focused on the ongoing war-related risk in Europe and fallout from the lockdowns in China.

“Simply put, there is not enough supply of sellable vehicles to support demand, and that issue is not expected to improve enough through the rest of the year to overcome the new risks,” he explains. “As recovery is pushed out even further and consumers feel more of the effect of rising prices, lack of demand may become the issue once supply can catch up after 2023.”

The May Manufacturing PMI® registered 56.1%, an increase of .7 percentage point from a reading of 55.4% in April, according to supply executives in the latest Manufacturing ISM® Report On Business®. This is the second-lowest Manufacturing PMI® reading since September 2020, when it registered 55.4%.

“The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment. Despite the Employment Index contracting in May, companies improved their progress on addressing moderate-term labor shortages at all tiers of the supply chain, according to Business Survey Committee respondents’ comments,” says Timothy R. Fiore, CPSM, C.P.M., chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee.

He notes panelists reported slightly lower quit rates compared to April. While May recorded a second straight month with slight easing of prices expansion, instability in global energy markets continues. Surcharge increase activity appears to be stabilizing across all industry sectors, and sentiment remained strongly optimistic regarding demand, with five positive growth comments for every cautious comment. Panelists continue to note supply chain and pricing issues as their biggest concerns.

Important takeaways, courtesy of the Manufacturing ISM® Report On Business®:

- Demand expanded, with the (1) New Orders Index improving, supported by stronger growth of new export orders, (2) Customers’ Inventories Index remaining at a very low level and (3) Backlog of Orders Index increasing.

- Consumption (measured by the Production and Employment indexes) was mixed during the period, with a combined minus-.7-percentage point change to the Manufacturing PMI® calculation.

- The Employment Index contracted after expanding for eight straight months, but panelists indicated improvement in ability to hire during May compared to April. Challenges with turnover (quits and retirements) and resulting backfilling continue to plague efforts to adequately staff organizations, but to a slightly lesser extent compared to April.

- Inputs – expressed as supplier deliveries, inventories and imports – continued to constrain production expansion.

- The Supplier Deliveries Index indicated deliveries slowed at a slower rate, which was supported by the Inventories Index increase.

- The Imports Index contracted after six consecutive months of expansion, reflecting the impact of COVID-19 lockdowns in China.

- The Prices Index increased for the 24th consecutive month, at a slower rate compared to April.

U.S. New Vehicle Sales

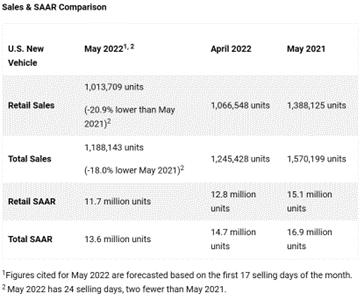

Total new-vehicle sales for May 2022, including retail and non-retail transactions, will reach 1,188,100 units – an 18% year-over-year decrease, according to a joint forecast from J.D. Power and LMC Automotive.

The seasonally adjusted annualized rate (SAAR) for total new vehicle sales is expected to be 13.6 million units, down 3.3 million units year-over-year.

“May results reflect a continuation of what has become the norm for the U.S. new vehicle sales environment,” says Thomas King, president of the data and analytics division at J.D. Power.

He notes inventory levels remain strained; though, for retailers and manufacturers, the increase in transaction prices, coupled with the near elimination of discounts on new vehicles, has more than offset lower sales volume to deliver enhanced profitability.

“For the balance of 2022, increased vehicle availability, higher interest rates and some cooling of used-vehicle values likely will lead to slower transaction price growth, but are unlikely to lead to declines,” King says.

Important Takeaways, Courtesy of J.D. Power:

- While the sales pace is down 20.9% year-over-year, consumers will spend $45.4 billion on new vehicles this month – the second-highest level ever for the month of May but down 15.5% year-over-year.

- Truck/SUVs are on pace to account for 77.2% of new vehicle retail sales in May.

- New vehicle prices continue to set records, with the average transaction price expected to reach a May record of $44,832 – a 15.7% year-over-year increase and the third-highest level on record despite rising interest rates.

- Average interest rates for new vehicle loans rose as well. The average interest rate for loans in May is expected to increase 62 basis points from a year ago to 4.92%.

- Total retailer profit per unit – inclusive of grosses and finance and insurance income is on pace to reach a May record $5,066, an increase of $1,679 from a year ago.

- Fleet sales are expected to total 174,400 units in May, up 3.8% year-over-year on a selling day adjusted basis. Fleet volume is expected to account for 15% of total light-vehicle sales, up from 12% a year ago.

“Three metrics in June that will demand focus are pricing, interest rates and trade-in values. The combination of future interest rate increases, along with elevated new vehicle pricing levels, will present a challenge to sustaining the current ‘Goldilocks’ economic environment. If used prices soften, so will trade-in values, which will reduce consumer purchasing power,” King says.

U.S. Used Market

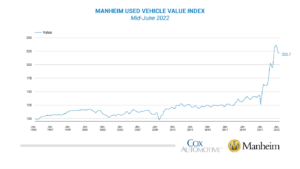

Wholesale used-vehicle prices (on a mix-, mileage- and seasonally adjusted basis) were essentially unchanged after the first 15 days of June – keeping the Manheim Used Vehicle Value Index at 222.7, a figure that is up 11.1% year-over-year.

“Used-vehicle prices are booming in May as the industry continues working through ongoing new vehicle inventory challenges. Wholesale prices are expected to rise 1.6%, marking the third-strongest performance of the month of May in the past 20 years. May will be the third consecutive month in which wholesale prices increase, placing them 37.2% higher year-to-date than a year ago,” says Jonathan Banks, vice president of Valuations Services. “On the retail side of the market, used prices remain near April 2022’s all-time high, while used vehicles continue to fly off dealer lots at a rapid pace.”

According to Manheim, most major market segments saw seasonally adjusted prices that were higher year-over-year in the first half of June. Pickups were the exception, with a 1.2% decline year over year. Vans had the largest increase at 24.8%, and both non-luxury car segments outpaced the overall industry in seasonally adjusted year-over-year gains. Compared to May, most major segments saw lower performance, except for compact and full-size cars, which were up .5% and 19.9%, respectively. The seasonal adjustment drove the declines, with SUVs having no change from May, while midsize cars and pickups dropped 1.1%.

KPI — June 2022: Recent Vehicle Recalls

Key Performance Indicators Report — June 2022