KPI — December 2021: Consumer Trends

The Conference Board Consumer Confidence Index® decreased in November, following an increase in October. The Index now stands at 109.5 (1985=100), down from 111.6 in October. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – fell to 142.5 from 145.5 last month. The Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – fell to 87.6 from 89.

“Expectations about short-term growth prospects ticked up, but job and income prospects ticked down. Concerns about rising prices – and, to a lesser degree, the delta variant – were the primary drivers of the slight decline in confidence,” Lynn Franco, senior director of economic indicators at The Conference Board.

“Meanwhile, the proportion of consumers planning to purchase homes, automobiles and major appliances over the next six months decreased. The Conference Board expects this to be a good holiday season for retailers and confidence levels suggest the economic expansion will continue into early 2022. However, both confidence and spending will likely face headwinds from rising prices and a potential resurgence of COVID-19 in the coming months,” Franco added.

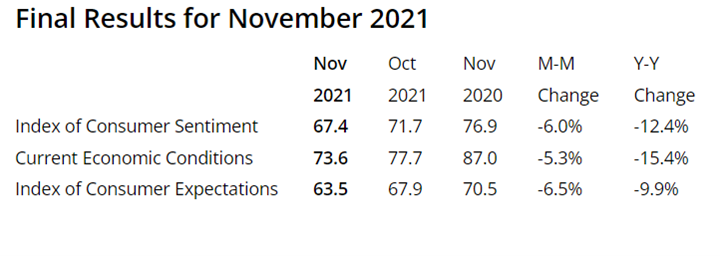

Similarly, The Consumer Sentiment Index – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions –declined sharply in November. At 67.4, “Consumers expressed less optimism in the November 2021 survey than any other time in the past decade about prospects for their own finances as well as for the overall economy,” according to the University of Michigan Survey of Consumers.

The decline is attributed to rapidly escalating inflation combined with the absence of federal policies that would effectively redress the inflationary damage to household budgets. While pandemic-induced supply-line shortages were the precipitating cause, Chief Economist Richard Curtin noted the roots of inflation have grown and spread more broadly across the economy.

Important takeaways, courtesy of Survey of Consumers:

- One-in-four consumers cited inflationary erosions of their living standards in November. Rather than gradually easing along with diminished shortages, complaints about falling living standards doubled in the past six months and quintupled in the past year.

- Consumers anticipated declining inflation-adjusted incomes, and expected spending cutbacks due to rising inflation to slow the pace of growth in the national economy in the year ahead. With one important caveat: consumers have a strong desire to resume more normal holiday gatherings with family and friends and to use their accumulated savings to fund their celebrations and gifts despite higher prices.

“Even when Biden’s social infrastructure program is finally approved, it will not immediately ease inflation nor wage growth,” Curtin stated. “The real transient issue is the rapidly closing window when effective policy actions can be accomplished by very modest nudges in interest rates and regulations.”

At present, Curtin said consumers still expect inflation to revert to a much lower level over the next five years, but that anchor has begun to yield ground: long-term inflation expectations rose by 0.5 percentage points in the past year, to 3% in November.

“If expected long-term inflation continues to accelerate in the first half of 2022, it will make its containment more difficult and, even more so, if the rise continues into the last half of 2022. Moreover, a protracted inflationary period will bring a renewed urgency for expanding government relief payments from job losses to cover inflationary declines in living standards. There will be no more compelling precedent for consumers than the 5.9% inflationary adjustment in Social Security payments that will start in January 2022,” Curtin explained.

Consumer Spending

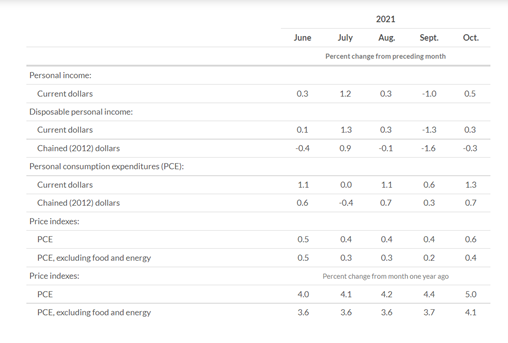

Consumer spending, or personal consumption expenditures (PCE), is the value of the goods and services purchased by, or on the behalf of, U.S. residents. In October, personal income increased $93.4 billion (0.5%), while disposable personal income (DPI) increased $63 billion (0.3%) and personal consumption expenditures (PCE) increased $214.3 billion (1.3%). Personal outlays increased $216.8 billion in October. Personal saving was $1.32 trillion, while the personal saving rate – personal saving as a percentage of disposable personal income – registered 7.3%.

The PCE price index increased 5% year-over-year, reflecting increases in both goods and services. Energy prices increased 30.2% and food prices increased 4.8%. Excluding food and energy, the PCE price index for October increased 4.1% year-over-year.

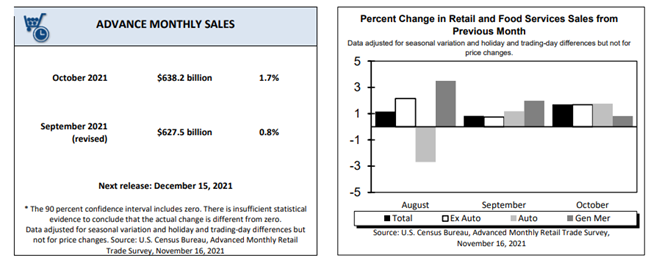

Advance estimates of U.S. retail and food services sales for October 2021 – adjusted for seasonal variation and holiday and trading-day differences, but not for price changes – were $638.2 billion, an increase of 1.7% (±0.5%) from the previous month and 16.3% (±0.9%) above October 2020. Total sales for the August 2021 through October 2021 period were up 15.4% (±0.7%) from the same period a year ago. The August 2021 to September 2021 percent change was revised from up 0.7% (±0.5%) to up 0.8% (±0.2%). Retail trade sales were up 1.9% (±0.4%) from September 2021 and up 14.8% (±0.7%) above last year. Gasoline stations were up 46.8% (±1.6%) from October 2020, while food services and drinking places were up 29.3% (±3.9%) from last year. The next Advance Monthly Retail report is scheduled for release on December 15, 2021.

Key Performance Indicators Report — December 2021