KPI — July 2021: Consumer Trends

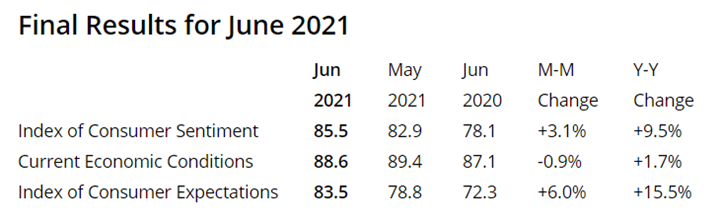

The Consumer Sentiment Index – a survey consisting of approximately 50 core questions that cover consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – finished at 85.5 in June, below market expectations of 87.4.

Although consumer sentiment slipped in late June, it remains 3.1% above the May reading and is the second highest rating since the start of the pandemic, noted Richard Curtin, University of Michigan Surveys of Consumers chief economist.

Consumers continue to pay close attention to three critical factors: inflation, unemployment and interest rates.

“While many are optimistic about a gradual end to the pandemic, consumers still judged the risks from emerging COVID variants as appreciable,” said Curtin. “It is likely consumers will not reduce their savings and wealth to pre-pandemic levels, but maintain a higher level of precautionary funds.”

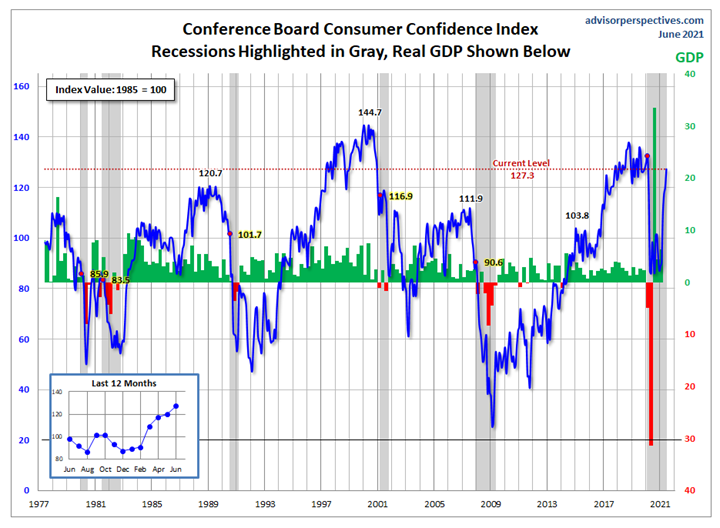

Furthermore, The Conference Board Consumer Confidence Index® improved in June, following gains in each of the previous four months. The Index now stands at 127.3 (1985=100), up from a reading of 120 in May and now the highest level since the pandemic’s initial surge in March 2020.

“Consumers’ assessment of current conditions improved again, suggesting economic growth has strengthened further in Q2. Consumers’ short-term optimism rebounded, buoyed by expectations that business conditions and their own financial prospects will continue improving in the months ahead,” said Lynn Franco, senior director of economic indicators at The Conference Board. “While short-term inflation expectations increased, this had little impact on consumers’ confidence or purchasing intentions. In fact, the proportion of consumers planning to purchase homes, automobiles and major appliances all rose – a sign that consumer spending will continue to support economic growth in the short-term. Vacation intentions also rose, reflecting a continued increase in spending on services.”

Jill Mislinski of Advisor Perspectives – a leading interactive publisher for Registered Investment Advisors (RIAs), wealth managers and financial advisors – put the recent consumer sentiment report into larger historical context as a coincident indicator of the economy. “Toward this end, we have highlighted recessions and included GDP. The regression through the index data shows the long-term trend and highlights the extreme volatility of this indicator. Statisticians may assign little significance to a regression through this sort of data, but the slope resembles the regression trend for real GDP shown below and is a more revealing gauge of relative confidence than the 1985 level of 100 that the Conference Board cites as a point of reference.”

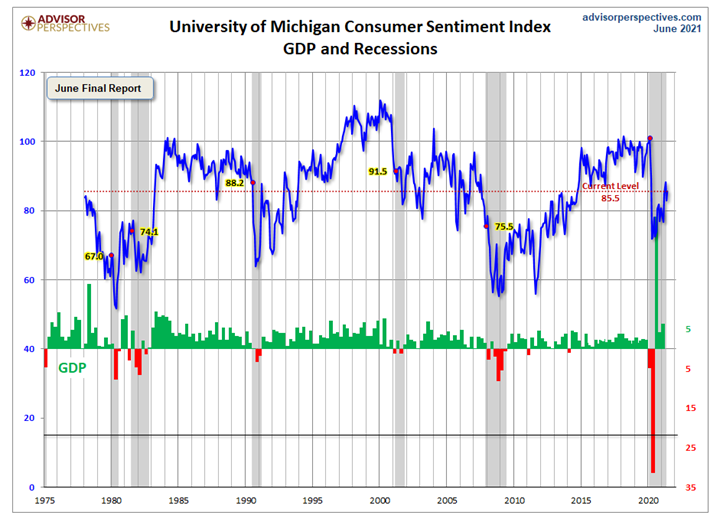

This is a long-term perspective on a widely-watched indicator. Recessions and real GDP are included to help evaluate the correlation between the Michigan Consumer Sentiment Index and the broader economy, according to Advisor Perspectives.

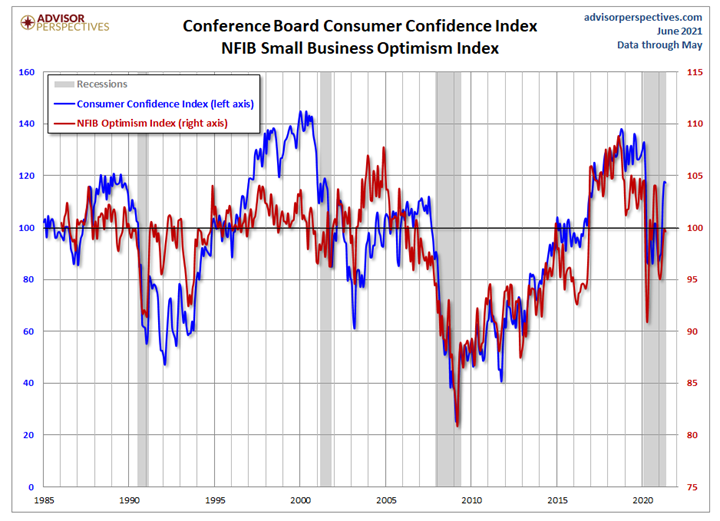

The prevailing mood of the Michigan survey is presented alongside the mood of small business owners, as captured by the NFIB Business Optimism Index (monthly update here). “As the chart illustrates, the two have tracked one another fairly closely since the onset of the Financial Crisis, although a spread appears infrequently, with the most recent spread showing up 2015 through present,” said Mislinski.

Consumer Spending

NRF’s calculation of retail sales – which excludes automobile dealers, gasoline stations and restaurants to focus on core retail – showed May was down 1.2% seasonally adjusted from April. However, unadjusted sales (as calculated by NRF) totaled $388.6 billion – the second-highest level of spending on record, outpaced only by $414.7 billion in December.

“Month-over-month comparisons and percentages of change simply don’t tell the story,” said NRF Chief Economist Jack Kleinhenz. “We are at a highly elevated level of spending, with dollar amounts in recent months some of the highest we’ve ever seen. Long-term trends in the number of dollars spent tell much more about the continuing economic recovery than whether sales were up or down from month to month. Retail sales as calculated by NRF were the second-highest on record in May, topped only by holiday spending in December. Demand has continued to be strong even as the concentrated impact from government stimulus has faded. There is still pent-up demand for retail goods and consumers are likely to remain on a growth path into the summer.”

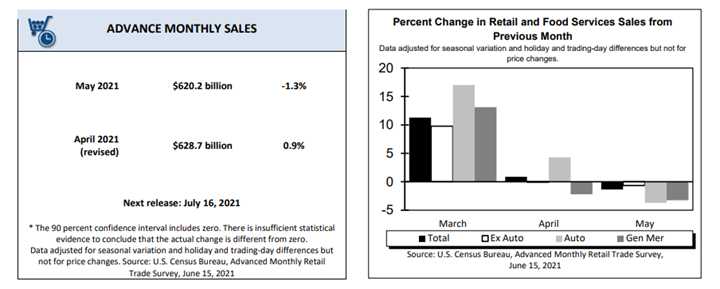

Advance estimates of U.S. retail and food services sales for May 2021 – adjusted for seasonal variation and holiday and trading-day differences, but not for price changes – were $620.2 billion, a month-over-month decrease of 1.3% (±0.5%) but 28.1% (±0.7%) above May 2020. Total sales for the March 2021 through May 2021 period were up 36.2% (±0.5%) from the same period a year ago. The March 2021 to April 2021 percent change was revised from virtually unchanged (±0.5%)* to up 0.9% (±0.2%). Retail trade sales were down 1.7% (± 0.5%) from April 2021, but up 24.4% (± 0.7%) above last year. Clothing and clothing accessories stores were up 200.3% (±2.8%) from May 2020, while food services and drinking places were up 70.6% (±3.0%) from last year.

Key Performance Indicators Report — July 2021