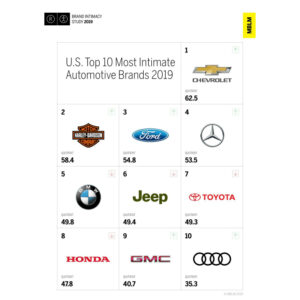

The automotive industry continues to be a strong performer and ranked second out of the 15 industries studied in MBLM’s Brand Intimacy 2019 Study, which is the largest study of brands based on emotion. Brand Intimacy is defined as the emotional science that measures the bonds we form with the brands we use and love. Chevrolet topped the automotive industry followed by Harley-Davidson and Ford. The remaining brands in the top 10 were: Mercedes, BMW, Jeep, Toyota, Honda, GMC and Audi.

In 2018, the automotive industry sold over 17.2 million vehicles, which represented its fourth best year in sales.[1] The Brand Intimacy 2019 Study also reveals that top intimate brands in the U.S. continued to significantly outperform the top brands in the Fortune 500 and S&P indices in both revenue and profit over the past 10 years. General Motors, the manufacturer of Chevrolet, had a 2018 profit of $10.8 billion, which is a drop of 8.3 percent from 2017; however, it still beat Wall Street expectations. Its sales were increased by the 2019 Chevrolet Silverado and 2019 GMC Sierra.[2]

“The automotive industry remained a dominant force in our 2019 report, with seven brands ranked within the Top 30 of our study. This is a category of brands that continues to connect emotionally with consumers. We know consumers identify with their car brands and have long-lasting, multi-sensory relationships with them,” stated Mario Natarelli, managing partner, MBLM. “However, there are surprising performances in the U.S. – especially domestic brands that continue to outperform their foreign rivals.”

MBLM’s study revealed additional noteworthy automotive industry findings including:

- Automotive had an average Brand Intimacy Quotient of 46.4, which was well above the cross-industry average of 31.0

- Fulfillment, which is related to performance, was the archetype most associated with the category and Toyota was the top automotive brand for fulfillment

- Chevrolet led the category and ranked #1 among both women and men. It was also the top brand among consumers with incomes under $100,000

- Honda ranked #1 for those making over $100,000

- Jeep was the top brand for millennials, whereas older consumers preferred Harley-Davidson

- BMW and Jeep dropped in the industry rankings since last year, while Harley-Davidson and Ford improved their position

- 35% of the industry’s customers were in one of the three stage of intimacy: sharing, bonding and fusing. This is the highest among any industry surveyed

MBLM also released an article examining the top-ranked brand in the industry, entitled, “Chevy Wins the Hearts of American Consumers.” The brand jumped in performance this year with a quotient score of 62.5, up from 48.5 the previous year. Nearly one quarter of users stated that they “couldn’t live without” the brand and 16 percent were willing to pay 20 percent more for Chevrolet, compared with 13 percent for the industry average. Nearly half of Chevrolet’s users also noted that they felt an immediate emotional connection to the brand. Demographically, the brand performed better with males, and at the lower-income scales and those in the 45–54 age range. One area in which it can improve is how actively it encourages customer engagement. As the automotive industry grapples with ride sharing and autonomous and environmentally-friendly vehicles, large manufacturers like Chevrolet must continue to build and leverage the bonds with their users to retain them as they try to transform their business and products.