Economic activity in the manufacturing sector increased during February, and the overall economy grew for the 130th consecutive month, said the nation’s supply executives in the latest Manufacturing ISM® Report On Business®. The February PMI® registered 50.1%, down 0.8 percentage point from the January reading of 50.9%.

The Report On Business® measures its data using the Purchasing Manager’s Index (PMI), which is an indicator of economic health in the manufacturing sector. A reading above 50% indicates that the manufacturing economy is generally expanding, while below 50% indicates that it is generally contracting.

“Comments from the panel were [mostly] positive, with sentiment cautious compared to January. The PMI® remained in expansion territory, but at a weak level. Four of the big six industries expanded, at similar rates compared to January. Four of the PMI®’s 10 sub-indexes recorded expansion, down from six the previous month,” said Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee.

Demand slumped, with (1) the New Orders Index contracting at a weak level, despite new export order expansion, (2) the Customers’ Inventories Index remaining at “too low” status and (3) the Backlog of Orders Index expanding for the first time in several months, but at a slow rate. Consumption (measured by the Production and Employment indexes) contributed negatively (a combined 3.7-percentage point decrease) to the PMI® calculation.

“Inputs—expressed as supplier deliveries, inventories and imports—strengthened in February, due primarily to supplier deliveries expanding, offset partially by inventories declining. Despite imports contraction returning at a strong rate, inputs contributed positively to the PMI® calculation, a reversal from the previous month. (The Supplier Deliveries and Inventories indexes directly factor into the PMI®; the Imports Index does not.) Prices returned to contraction, at moderately strong levels,” continued Fiore.

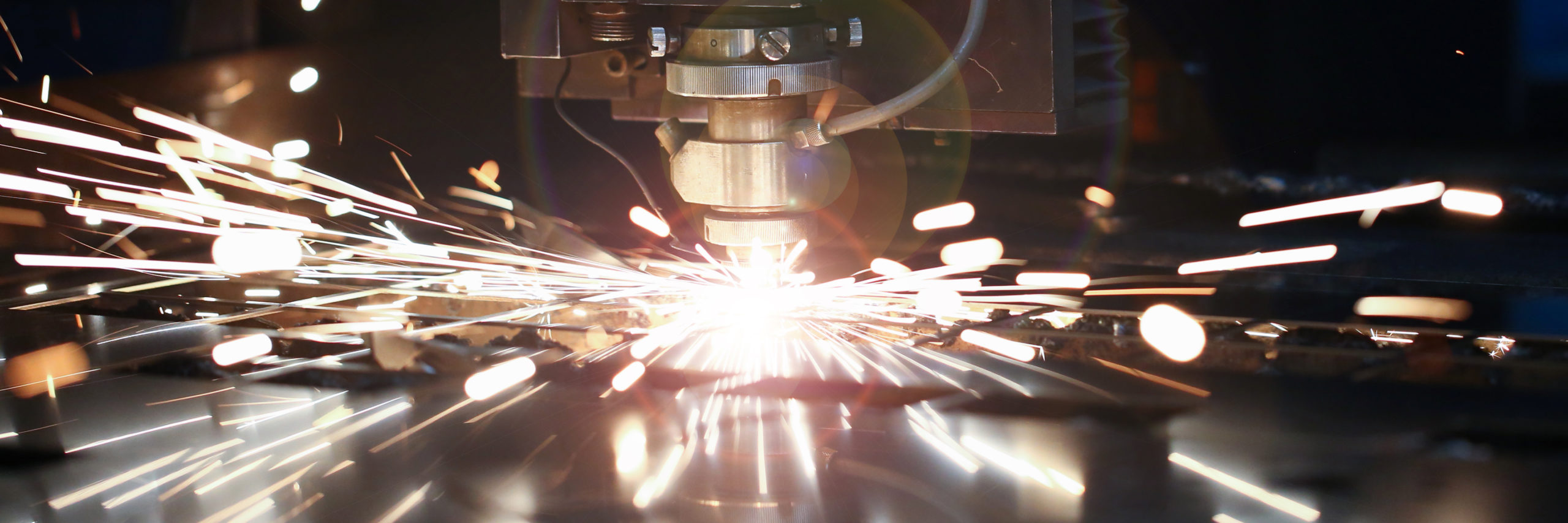

Of the 18 manufacturing industries, 14 reported growth in February: Wood Products; Furniture & Related Products; Plastics & Rubber Products; Printing & Related Support Activities; Paper Products; Textile Mills; Primary Metals; Food, Beverage & Tobacco Products; Computer & Electronic Products; Miscellaneous Manufacturing; Electrical Equipment, Appliances & Components; Fabricated Metal Products; Machinery; and Chemical Products. The three industries reporting contraction in February are Petroleum & Coal Products; Transportation Equipment; and Nonmetallic Mineral Products.

What Industry Professionals Are Saying

• “There are always supply chain challenges with Lunar New Year shutdowns, and this year is no different. Coronavirus is wreaking havoc on the electronics industry. Companies are delayed in starting up production, which is resulting in longer lead times, constraints and increased pricing. It’s a mad dash to dual source stateside in case China isn’t back online soon.” (Computer & Electronic Products)

• “January started out strong, but the effects of the virus in China [and] the continued grounding of the 737 Max have suppressed new orders. We are still expected to be flat to slightly up [year-over-year] for 2020 sales, based on those issues.” (Chemical Products)

• “Layoffs are here.” (Transportation Equipment)

• “Coronavirus and its impact on the supply chain: We will see some softness in demand, but also [experience] havoc on items sourced from China that may cause significant delays to production.” (Food, Beverage & Tobacco Products)

• “Energy markets seem to be responding to a potential drop in demand that may be related to responses [to] the coronavirus.” (Petroleum & Coal Products)

• “Coronavirus continues to be front and center as a major supply chain risk to our company. Access to information in China—from our supply base and customers—is slow to come by.” (Fabricated Metal Products)

• “Sales continue to be strong, with the supply base able to support as required. The major concern is the China virus and what that crisis could affect in getting parts. The company is putting plans in place to source out locations, especially in the U.S., for parts.” (Machinery)

• “Business continues to be strong. We had a little January slowdown, but February has been fantastic.” (Plastics & Rubber Products)

• “We have seen an increase of sales for our products.” (Furniture & Related Products)

• “Current favorable forecast to budget for first-quarter sales.” (Primary Metals)

• Commodities Up in Price: Capacitors, Crude Oil* (2), Resistors, Steel—Hot Rolled* (4) and Steel Products

• Commodities Down in Price: Aluminum, Aluminum Products (2), Copper, Corrugate, Crude Oil*, Natural Gas (3), Polypropylene (4), Scrap; Steel—Hot Rolled* and Steel—Stainless

• Commodities in Short Supply: None

*Indicates both up and down and price. ( ) The number of consecutive months the commodity is listed is indicated after each item.

New Export Orders*

ISM®’s New Export Orders Index registered at 51.2% during February, a decrease of 2.1 percentage points compared to the January reading of 53.3%. This is the second consecutive month of growth. “New export orders remained in expansion territory, but at weaker levels compared to the prior month. Three of the six big industry sectors expanded during the period, up from two the previous month. Many respondents reported that their operations were impacted by the coronavirus outbreak,” said Fiore.

The eight industries reporting growth in new export orders this month include Wood Products; Paper Products; Furniture & Related Products; Electrical Equipment, Appliances & Components; Food, Beverage & Tobacco Products; Fabricated Metal Products; Transportation Equipment; and Machinery. The four industries reporting a decrease in new export orders are Nonmetallic Mineral Products; Plastics & Rubber Products; Chemical Products; and Miscellaneous Manufacturing.

Imports*

ISM®’s Imports Index registered at 42.6% during February, a decrease of 8.7 percentage points when compared to the 51.3% reported for January. This indicates that imports contracted after growing for one month. “Imports returned to contraction territory, with the index recording its weakest performance since May 2009, when it recorded 38.5%. Respondents noted the combined effects of the Lunar New Year as well as the coronavirus. Lower imports will continue as the effects of the virus are better understood,” explained Fiore.

The five industries reporting growth in imports this month are Wood Products; Printing & Related Support Activities; Nonmetallic Mineral Products; Furniture & Related Products; and Plastics & Rubber Products. The 10 industries reporting a decrease in imports include Electrical Equipment, Appliances & Components; Apparel, Leather & Allied Products; Primary Metals; Petroleum & Coal Products; Fabricated Metal Products; Transportation Equipment; Machinery; Computer & Electronic Products; Chemical Products; and Food, Beverage & Tobacco Products.